A coalition of fiscal officers from 27 state governments called President Joe Biden and Federal Housing Finance Agency (FHFA) Director Sandra L. Thompson to jettison the new mortgage fee increases that went into effect today.

In a letter to Biden and Thompson, the fiscal officers declared the new policy a “disaster” and said the fee increases will create new financial burdens for homebuyers with good credit by forcing them to pay more on their monthly mortgage bills.

“The policy will take money away from the people who played by the rules and did things right – including millions of hardworking, middle-class Americans who built a good credit score and saved enough to make a strong down payment,” the letter said. “Incredibly, those who make down payments of 20% or more on their homes will pay the highest fees – one of the most backward incentives imaginable. For decades, Americans have been told that they will be rewarded for saving their money and building a good credit score. This policy turns that time-tested principle upside down.”

The fiscal officers, who are led by Pennsylvania Treasurer Stacy Garrity, acknowledged “a gap in access to credit and that low credit scores are a significant barrier to buying a home,” although they also cited affordable housing assistance programs are available. They also noted the new policy does not to address the historic lows in current housing inventory.

“But the right way to solve that problem is not to use the power of the federal government to penalize hardworking, middle-class American families by confiscating their money and using it as a handout,” they continued. “The right way is to implement policies which will reduce inflation, cut energy costs and bring lower interest rates. Doing so will enable more families to save and improve their credit scores. Increased financial literacy efforts must also be part of the solution.”

The letter ended with the request for “immediate action to end this unconscionable policy.”

Biden has never publicly commented on the mortgage fee increases. Last week, Thompson’s office issued a statement claiming that “much of what has been reported advances a fundamental misunderstanding about the fees charged by the Enterprises, and why they were updated.”

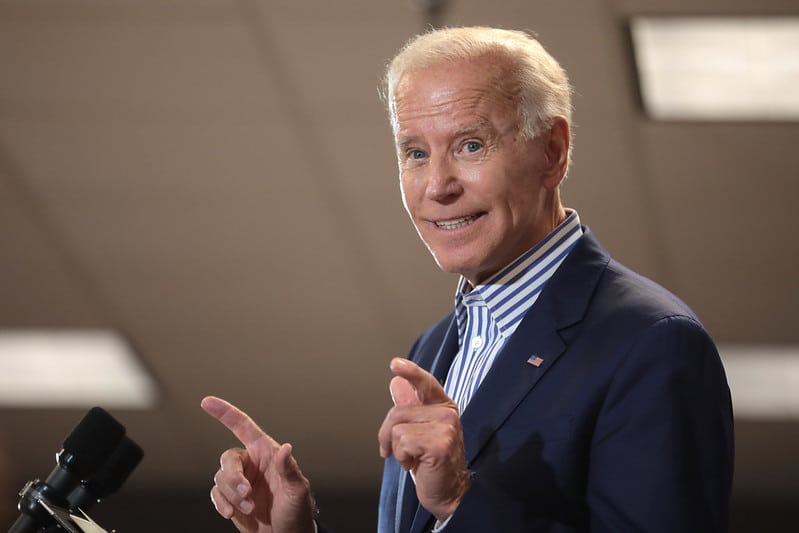

Photo by Gage Skidmore / Flickr Creative Commons

Good! Let them know that it is a disaster to penalize those that play by the rules. It is another screwball attempt to ruin our economic system. This is Third World strong arm tactics that attempt to ignore market forces.

Absolutely. It makes no sense unless you want to punish those who have earned their money with hard work and reward others for votes. Pres Biden is totally lost his mind so others are running this country. Time for change

I agree with you 110%

This is the stupidest thing I’ve ever heard. I have worked my whole life saving money and keeping a high credit score and now Biden wants me to suffer for it? This is preposterous!

I agree. This country is not for the American people anymore. It’s for the government ( BIDEN).

How can this be legal? Since when does the government step in and act like Robinhood, stripping our hard earned money from us and give it to the poor? HUGH overstep by the Biden administration!

The government has been doing just that for years, your tax dollars at work!

This criminal administration has been a disaster from day 1. Government of the people, by the people and for the people as it was intended to be is OVER. The sooner everyone figures it out the better. Doing the right thing no longer matters so I am thankful to see SOMEONE standing up for law abiding taxpaying citizens. Thank you for that.

I have never seen a more unorganized and mathematically incompetent group of people in my entire life! Biden, being a social retard speaks for himself, when he can speak! But how can so many other people make such economically destructive ideas? I was always under the impression that these people had extreme education in economics and business…….there simply has to be a plan to all of this madness. Normal people do not act this way and destroy the greatest Country in less than 2-3 years. It will take decades to get this place running up to par again, as we speak. COUNT ‘EM 2-3 years!

Great.. it’s total BS. I’m honest and worked hard for my good credit as like many other Americans. Why should we pay for people that didn’t? And what incentives would people have to keep good credit?

Bravo, exactly my sentiments, why penalize the people with good credit making them pay higher rates. Our industry is suffering with the poor economy, higher interest rates, etc. what are they thinking? History repeating itself, back to giving loans to unqualified people will be disaster again.

I was told that as long as you don’t use a bank that sells to Fannie Mae this does not apply. Once again doing the right thing and paying your bills you will be penalized. When I heard this on the radio one day I thought they were kidding. Joke is on us hard working middle class once again.

Almost all home loans are sold to Fannie Mae and Freddie Mac; both will use this policy. You would need to find a bank that services their own loans to avoid this penalty, and that is very rare now.

Adding another fee with zero in return for good credit responsible buyers. All the lessons I taught my kids about financial responsibility for what? The “middle class” buyers who have worked so hard to buy a home are the exact ones with childcare, higher taxes and on and on. Where is Frank Dodd?

As a real estate agent, I can only see this leading to more economic failure, short and long term. This tactic will discourage middle class buyers; and downsizers and seniors will follow suit. A home is still the ultimate dream for those who earn it. Frivolous spending and lack of money management skills have gotten a lot of people into their impoverished life. Some sacrifice is required to save, invest wisely and live well within your means. The housing market is already suffering enough with low inventory, lack of new starts and volatile interest rates. Just maybe this would be a good time to get the 1% to pay higher taxes and pass the loopholes to the impoverished.

You are absolutely right!! I have been a Realtor for 38 years and this is a true recipe for disaster setting us up for another season of foreclosures! Please let common sense prevail!!

There are many reasons why someone may have a low credit score. You can not say they did not play by the rules. One area that should not penalize people for a lower score is in car loans. It is ridiculous how having a lower credit rating makes your car payment almost unmanageable. Then that has an impact on your rating because your payment may put you over the edge for liability to income ratio. And I am not talking about buying anything fancy, just a average family car. A divorced woman’s credit rating may also get damaged because her earnings will reduce her buying power and therefore her credit rating even if she was the one with the better credit score while married. There are different ways to do this, basing fees on on loan amounts not on credit scores is one way. Lower credit scores are going to mean a higher interest rate overall in our current paradigm but it shouldn’t mean you have to pay more for the loan transaction. Credit cards should not be allowed to charge such high interest rates. If you have run up a bill (and these could have been necessary purchases-not fun vacations) it is impossible to get them paid off.

And once again you take a hit to your credit score, even if you are making more than the monthly payment. Liability to income limits again come into play. Let’s look at what is really wrong in America-stagnant pay structures, unequal pay structures, living wage inequities. This is where the bulk of the problem is, if wages were correct then less credit would have to be relied upon. Less credit debt would allow for more savings. More savings would allow for larger purchases. And as far as our inflation problems go-most of the current situation was built out of COVID supply and demand problems. You can not increase supply if you are going to raise interest rates and make it too expensive for companies to relocate their manufacturing facilities back into the United States or get the funds needed to expand their facilities. Any food company that is back up and running fully should be lowering their prices. Gas companies should not be allowed to have multimillion dollar quarterly profits while everyone else is experiencing increasing costs. And raising the cost of mortgage loans overall is really hurting the housing industry. Were they too low, too long, absolutely but this rapid jump is too much. Let’s look at the whole picture and not just try to kill the housing market and the rules are rigged so don’t talk about playing fair. To keep upping the top credit score is rigging the game so there is that problem also.

It seems you are repeating everything the former President said — when Gas was $1.87 a gallon, eggs 96 cents a dozen, mortgage rate 2%, home prices affordable. Let’s hope US votes to restore the values of Americans — you spend what you can afford, you don’t bet on making a fortune by going to an expensive college that you can’t afford, and you don’t want the government passing laws that interfere with basic freedoms. And, no matter what the family name, you can be charged with treason when you sell your soul to America’s enemies.

I thought the Lender had guidelines to follow to make sure the borrower was credit worthy. Want to help people get into homes? Get the interest rates back down under 5% and it will be easier for someone to qualify for a mortgage because their payment will be less. Artificially approve them and we will have a glut of foreclosures within a year or two. 2008 anyone? Liar loans? Remember? I will just stop paying some of my debts so my credit score can plummet before I buy a home again. Two can play at this game.

When you reward bad behavior you get more bad behavior. It appears what this administration wants is more people to be irresponsible and lower their credit scores. It goes along with their philosophy on crime. Very consistent lunatics.

Credit scores affect everything you do in life. They are even reviewed by potential employers. Yes, they look at your credit as an indicator of your reliability and character. Get your credit scores up. Do without unnecessary expenses – mani/pedi, expensive hair salon treatments, cut back on clothing, shoes, eating out and pay your bills on time. You and your family will reap the rewards and life will get better.

This crazy policy makes perfect sense for those in favor of “reparation”. Taking from the “rich” and giving to the “poor” to even the playing field is what this administration stands for. The sooner we get them out and replaced by those who represent the majority of hardworking Americans who have contributed to the growth of this Country, the better off we will be. The next Presidential election will hopefully rectify the problems this Country is facing and get things back on track to Americas prosperity. The American Dream has been hijacked by a bunch of bandits who will lie, cheat, and steal from those who have worked hard to get to a comfortable place economically. Anyone who disagrees with them is called a racist. This has nothing to do with race! America, wake up and take a stand for what is right! Speak out for what you believe. There may come a day that you will regret not doing so.

GO BRANDON!

This is FAKE NEWS. Biden didn’t implement any changes. The FHFA committee had to rebalance risk associated with Fannie and Freddie loans so more loans could be securitized and sold in the secondary market. No one pays an “extra fee” for someone else’s mortgage. This lets them do MORE home loans across the board. If you look at the FHFA matrix (just google it) you will see that higher credit score borrowers pay less and lower borrowers pay more. There are no “extra fees”. Too much risk had been associated with some downpayment and credit combinations and that had to be increased so the risk pool of those insured loans is within limits. It has NOTHING to do with people being punished.