Sen. Elizabeth Warren (D-MA) is leading a coalition of more than 30 progressive members of Congress calling on President Joe Biden to take executive order actions to lower the cost of housing.

In a letter to Biden, Warren and her fellow progressives called on the administration to direct the Federal Housing Finance Agency to set “price gouging protections,” to order the Federal Trade Commission to finalize its proposed rule to ban junk fees while calling on the Consumer Financial Protection Bureau to “address anticompetitive closing costs and junk fees, lowering closing costs for home mortgages and making homeownership more accessible,” and to order the Department of Justice to investigate if the Fair Isaac Corporation (FICO) is violating antitrust law.

The lawmakers also asked Biden to coordinate reform on Title V of the McKinney-Vento Homeless Assistance program “so that federal property can more easily be leased by affordable housing providers who are serving people experiencing homelessness.”

“We strongly encourage you to cement your legacy by addressing one of the most pressing economic issues of our time and take swift action to create more housing and lower housing costs for Americans everywhere,” said the letter.

Among the lawmakers joining Warren in signing the letter were Sen. Bernie Sanders (I-VT) and “Squad” members Reps. Alexandria Ocasio-Cortez (D-NY), Ayanna Pressley (D-MA), Rashida Tlaib (D-MI) and Jamaal Bowman (D-NY).

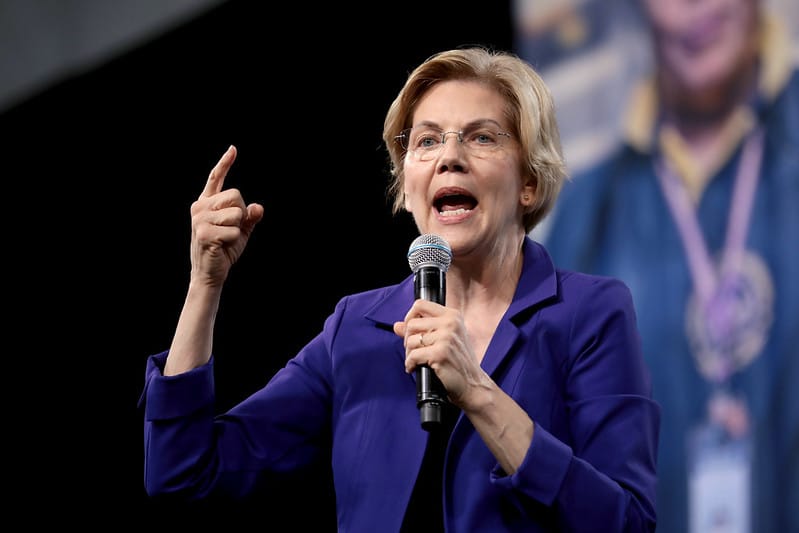

Photo: Gage Skidmore / Flickr Creative Commons

Just what we need, more Govt. give aways that will end up in a tax

cost to those who work!

It’s not about giveaways. Its about stopping inflated costs and procedures that prevent honest, hardworking people who don’t make six figures from owning homes. Many have good credit and are stand up citizens, but just don’t have the funds to pay all the costs of purchasing a home. Many are paying a “mortgage” in the form of rent paid to someone else. But, they have too many barriers to entry in getting a mortgage of their own.

It’s called “Saving to buy a home” – not stealing from taxpayers!!!

“Inflated costs” are the cost of providing the service in a capitalist society. The extra costs are what is necessary to provide the products and services in the way required by government statutes and rules. The government creates rules to protect people, which can be great, but nearly always increases costs. These costs can come in the form of extra man hours, materials, inspections etc. eliminating “junk fees” just increases the base costs or kills the small business that can’t compete with the big guys. This isn’t a simple solution. We need more inventory and less regulation to decreases costs. If we eliminate the little guy and create more barriers to entry the costs will actually increase in the long run and pad the corporate wallets which is the opposite of what this train of though desires.

Housing construction costs have increased considerably. So many new safety laws have increased costs along with septic systems. I live in an area that is predominately owned by the National Seashore and we lack land for development.

Our zoning laws are very strict which include height requirements and historic commission has halted many a project.

I love the National Seashore and what the historic commission does to preserve our town.

There needs to be some sort of compromise in order to grow. Being a vacation and seasonal community, we lack housing for the service people in town. A critical problem with no solution.

Actually, for seniors, there’s more to it than what you think! Let me explain.

There was a quiet little niche’ in Sun City community, located in Riverside Co in Southern CA, centrally and conveniently located an hour drive in each direction, to San Diego, Palm Springs, Los Angeles Co, and Orange Co, where Del Webb built his 2nd 55+ single family residential subdivision, in the early 1960’s, of 4k +/- homes consisting of a few townhomes, quite a few condo buildings, and the balance in single family homes. Since that decade, after Presley came to town and purchased the balance of Del Webb’s 55+ approved subdivision, in the early 1970’s, upon Webb laying out the utility line infrastructure in the newest subdivided roads of his subdivision, the next spurt of 55+ housing developments were in the late 1990’s, early milenium turnover in 2000, after the roof construction changed to Spanish roof tiles. All said and done, and to date, there are 15+ SENIOR 55+ subdivisions, located in Sun City Community, and still counting. In Oct 2008, the Menifee community, next door to Sun City, at that time property legal descriptions were recorded as “an unincorporated area in Riverside County”, incorporated, and merged Sun City & 2 other communities, now each recorded as “community in the city of Menifee”.

After 2019 COVID 19 devastation, when the economy began to “live”, investors from San Diego, Orange Co, L.A. suddenly appeared in Sun City community, buying up the Single Family Residences from seniors. The seniors were having a rough time of surviving and investors found out about our comfortable niche. We didn’t have much in the way of business, our community income was low, some in poverty, but at least they either had owned their home, or were renting it out to another senior to supplement their low Soc Sec income that most seniors didn’t have much over $800/mo. Investors took advantage of the seniors by enticing them with “cash out”, and one right after another renter ended up in a devastating dilemma because the housing sales and rental prices were escalating beyond belief that the Seniors being tossed out of a home couldn’t locate a replacement without paying more than they could afford, causing them to apply for HUD’s S8 Affordable Housing Assistance; but the list was 7 yrs long; therefore, no immediate assistance was available; therefore, if they didn’t find family, friends, or a Landlord that wasn’t “greedy” for the “almighty BUCK”, some Seniors, including our grandparents in their 80’s or 90’s, in some cases, were living on the street, if they didn’t qualify for mature independent living or a care facility.

I am also a victim. I am a VA VietNam era widow of 78 yrs young, still working “until I am 90, unless I die first”. I lived in a townhome for 15 yrs. I made an “over the value” offer to the owner in 2022. After all these years, I had no idea she had a Real Estate Agent friend from out of our City (San Diego); therefore, I thought I was working with the Owner directly. She advised me, in writing, awhile before the offer date, that she will not sell to a flip investor buyer because this was her parents’ home, that she received as an inheritance, therefore, she wants to preserve it for another Owner Occupant SENIOR Buyer. I assured her my purpose, after 15 yrs of residency, is to update it and repair the deferred maintenance that she didn’t maintain, for the purpose of my “forever” home. Well, even though I did my homework, obtaining bids, and even hired an appraiser to give me pointers of lender appraisal conditions, that the main concerns were “lead-based paint” peeling, as a pre 1978 built residential structure, that I offered to the owner that I would spend the money to have the work done before the lender appraisal.

But, her agent, although he said he rcvd and read all my emails & text msgs I sent the owner with the above details and my offering price, guided the owner to not accept my offer due to the VA appraisers scrutinizing the deferred maintenance home unfavorably. The Owner said she would honor my offer before others; but she rejected my offer and accepted an investor offer over mine, which means cash. I offered $232k, the accepted offer was $140k. I offered high because most of the deferred maintenance homes on the market in 2022, were sold;;therefore, there were no comps. So, I was relying on the appraised amount to guide us.

And, I lost, big time!

I have moved from 1 roommate situation after another for the past year, I can no longer afford to buy or rent a home or condo with price escalation, anywhere, particularly in the Senior community where I have the right to be. And, now that the industry rules changed, my income has dried up.

Now, I will need to apply for HUD S8 Affordable Housing Voucher program at 78 yrs young, if I don’t locate a job to pay my rent that this owner is planning to increase in 3 months, and again in 6 months because HUD S8 Standard Rent on a 1 bdrm unit I found for $1450/mo is $1700/mo in RivCo effective 10/2024. And, although I gave away half my furnishings, because this condo has serious deferred maintenance, with water drenching the extra room floor in the rain, I am still paying $650/Mo for my storage units. Therefore, currently, my rent for a 1 bdrm unit is $2100, going up to $2200 in Jan 2025, on my VA DIC (VA Army husband KIA in Vietnam in 1970) at $1825/mo. Haven’t applied for my Soc Sec because I need to pay in another 4 quarters that I haven’t made enough money to pay into, and since my husband was 24 at his death, I can’t collect on his, since all that was in his account paid me to raise our 2 children.

So, I make too little to pay today’s rents, and too much for assistance. Food stamps will only be $24/mo for me, with today’s prices!?!

That’s MY STORY, “in a NUTSHELL”!

This is a situation where I wish one of those super-rich philanthropists would come in and help your whole community to make it go back to the days when it was easily affordable. I’m so sorry for your plight!

I do agree that much can be done to lower costs of making home ownership more affordable, but not on the backs of private individuals! If they want housing costs to be lower for renters, then it must be government-built housing where they can keep the rents lower. I have often felt that all this government land I see vacant all over the place should be put to use, when so many are struggling, and living on the streets! I won’t say the exact area, but there is a whole neighborhood of beautiful older homes (built in the 1940- 1950s) formerly an Airforce Base where at least 150 homes sit vacant and deteriorating! WHY?

These folks have to do what every American before them have done. Save their money, ho yo school at night after work to increase their earning potential. Not every person is born to own a home

Correct. I bought my first house a little after my 22nd birthday, how? Work, save, work, sacrifice, work….Get it?

Naivety can be so serene and blissful. You sit there with your legs crossed, eyes closed, palms on your knees face up, take a deep breath and either goeHaummmmmmmmm. or Cumbi ya my Lord. Nia, when you can nail down inflated costs & procedures, without freebies, please let us know. You might consider taking a few courses such as, reality, supply and demand, and judging by your last sentence, grammar. Why comment if you’ve got nothing to say? You’re much better off blissfully going haummmmm…..OH, and rent is normally something paid to someone else……

Best way to get housing cost down is to lower mortgage rates to where they where before Biden got in office.

So mortgage rates went up because Biden was in office?

Yes. Absolutely. He printed SIX TRILLION DOLLARS. That causes Inflation. High inflation causes high interest rates. Take Econ 101.

Senator Warren may have the best of intentions for ‘affordable housing’ however, with each of her ‘kind heart intentions’ she helps create deeper problems for ALL such as huge deficit government spending and borrowing costs and more Inflation. Let the economics of a real

Economy driven by manufacturing, energy creation, technology and more create jobs and real income. Next, after the affordable housing, she will ask for more tax monies to pay for her idealistic spending to appease her audience.

She forgets. Lending costs went up with the CFPB and Dodd Frank Act that she pushed. She is why costs are higher.

Interesting how she “forgot” that!

Yep. That fake Indian might not have created the “Community Reinvestment Act” that caused the 2008 housing crash, but her cronies did. Anything the government gets involved with with only make things more expensive and less efficient. This sounds like another hustle to increase taxes and increase the ability to skim out kickbacks, while doing nothing to actually affect supply and demand (the real thing that sets home prices). If they wanted more home affordability, they should lower all taxes and eliminate most of the federal, state and local “fees”. Why entrust the government (or anyone) with more of YOUR MONEY, when they cannot effectively manage what they already have. The government has zero fiduciary accountability.

A free market is preferred to overreaching government involvement.

More Government oversight raises the cost to the consumer.

There end game is always, to destroy free market capitalism, forgetting always that it is captalism that has lifted nations and millions of people out of poverty. They don’t give a crap about the people, they just want to look like they do.

Another worthless government employee who knows dangerously little about what she’s asking.

Typical, government screws something up and then rides in on their white horse to “fix” things and catch the bad guys, but they always need more money to do it!

How about the NRA lawsuit that now wants added cost to the buyer on top of a high housing market they didn’t think twice about how it will effect the buyer

You mean NAR, right?

I think the new rules will be a wash. In the large majority of cases, sellers will need to offer to pay the compensation for the buyers, because as you noted, the buyers don’t have the extra cash. It’s still the same pile of money, but now the seller has an option. Actually, sellers ALWAYS had the option. But their field of potential buyers will shrink from 100% to probably 20% (cash buyers). And the negotiations will right that market, because there would be 80% less chance for multiple bids. In my market, sellers are still offering to pay the buyer’s commitment to their Realtor.

Homeowners insurance is going to be the silent transaction killer.

How about they just lower interest rates well below 5% so working Americans can pay what they pay now for rent (or less) but toward a mortgage instead?

Lowering interest rates has an effect on the rest of our $$ investments. I don’t know enough about it to be conversational, but things have to even out. Still, 2022 sure was a fun time for property sellers and re-fi’s, but lordy, buyers gobbled up properties well above the sales price……and now the entire market $$ is inflated. I hope those 2022 buyers don’t need to sell anytime soon.

Consumers already have the right to shop for title companies, escrow companies, lawyers, Realtors, lenders, etc. Exactly what “junk” fees is she referring to?

She and her cronies consider Agent commissions junk fees.

Funny how they never say what exactly are the “junk fees”

Every time they step in with their “government assistance, it just raises costs instead of lowering them. The middle continues to get squeezed

Yeah, the good ol’ gov-mint assistance: Throw someone else’s money at the problem. The govmint spenders desperately need to put themselves on a fiscal diet. Oh wait, I think Congress was originally charged with doing just that: Keep the Fed nose out of States’ business. I sure wish we had more Tom Coburns (RIP) in Congress and less of the careerists who are out of touch with the reality of a genuine dollar.

Has she lost her complete and total mind ?? Am completely dumbfounded by this suggestion

The JUNK fees we need eliminated are the regulatory fees, costly building codes, user fees, GFC fees, permitting fees, utility hook up fees and other City and State fees that add tens of thousands of dollars to the cost of a home. Of course this article calls on the gov’t to tell someone else the fees they can’t charge. Hypocritical much??

Nailed it. I think I love you.

This is the dumbest plan and WILL NOT work to lower the cost of home ownership.

How about this, stop paying for Illegal aliens 3200/month free everything 188 billion to Ukraine Rates will come down not doubling the interest rate s from 2.75 to 7Percent Pocahontas!

Bribem and Kommiela have been running a Dictatorship with a blizzard of Executive Orders” for 4 years. Then Kommiela is “installed” as the VP candidate.

Where’s Congress?? Time for the Dictatorship to end!! Time to end the Squad and moron Warren!!

STOP “Flip Investor Housing Buyers” from buying SINGLE FAMILY HOMES, so OWNER OCCUPANT Buyers have a home of their own to raise their families, so they are not constantly uprooted by “GREEDY” “money hungry “flip investors” to “MAKE A QUICK BUCK”, on the backs of “middle income” America!

I get what you’re saying. Thing is, most of the owner-occupant buyers need a loan to help buy a house. To get that loan, the property must, at a minimum, pass appraisal inspections before the HOUSE qualifies for the loan. Investors look for those properties that need such repairs, find the funding, make the repairs and usually upgrade things like appliances, baths, kitchens, flooring to catch a buyer’s eye, then put them on the market at the going price. They can, in fact plan to, “make a quick buck,” after they pay back their loan and interest, and cover their expenses which can be significant. I have a client who wants to find a property he can purchase “cheap” and then fix it up himself. Problem is, the type of financing he needs requires that appraisal test. There ARE home-improvement loans available. It takes good credit, a lot of planning and getting estimates, following through, keeping records, etc. But a buyer who can do this CAN get one of those properties. This is not for the faint-of-heart buyer. There is significant risk, because expensive defects might have been overlooked which means $$ out of your pocket, along with the initial mortgage and the home-improvement loan. So you’ve GOT to do your research, and you’ve got to have some building skills/knowledge because YOU will be the superintendent on the job. Check out FHA re-hab loans.

)

Great comment on the owner occupied fix up loans. FHA and Fannie-Freddie offer them.VA is tough because typically a 100% loan and a lot of risk if property has issues.

Liz Warren is obfuscating the real cause of unnecessarily high housing, and other costs, with typical leftwing false assertions regarding “junk fees” and “price gouging”. Like all divisive, cynical power-hungry politicians she provides no proof, or even credible evidence, of “junk fees” or “price gouging”; they are false allegations that demonize tens of thousands of honest hard-working Americans in the housing and financing industries.

The truly unnecessary cost increases for housing result from excessive government regulations (i.e. NEPA, Fair Housing, etc), delays and other impediments to producing more houses at lower costs. Similarly, excessive government debt and spending (i.e. Inflation “Reduction” Act, American”Rescue” Plan, and “”Green New Deal”), drives inflation to historic highs resulting in higher interest/mortgage rates.

Government, particularly leftwing policies driven by politicians and bureaucrats with zero business and housing industry experience, is the problem.

Zero business or industry experience is EXACTLY a huge part of the problem. Lemme share one of former Oklahoma Sen Tom Coburn’s (RIP) findings on misspent Fed research $$ (in my state): A university rep made a presentation for Fed funds to study how to increase the effectiveness of goat fences. The university was awarded $300,000 to establish a testing center. It gets even more interesting: The SAME university had already looked at the issue IN THE PAST and found a “simple procedure” to transition cattle fences into goat-proof fences. Add a few more strands of barbed wire. That probably cost a 10-cent cup of coffee at the diner to come up with that resolution, because us farmers and ranchers in Oklahoma–and most of the world–can keep our silly bleating smelly goats on the right side of the fence. Geez.

Here are a couple more, just in Oklahoma: Federal Funds Supporting Housing Authority with NO RESIDENTS. Thank you HUD for watching over my tax dollars. Another one: $16 million in stimulus funds have been spent in OK towns for sidewalk projects in towns that did not need/even want them. One such project resulted in a walkway leading to a DITCH. The new and rarely used sidewalks, which cost an estimated $100K per block (in 2011 dollars), were built to head off future disputes with overbearing fed regulators. Without them, State highway planners indicated critical fed HIGHWAY dollars could be withheld on future projects. There are many, many more horror stories.

A group of people punch drunk from drinking at the taxpayer money trough.

Pocohantas warren is a joke including the other lowlifes on this attempt to get MIA biden to secure “his legacy” and make housing affordable — too funny! Im still wondering how she’s even around after being caught that the CFPB that she lords over, is a slush a fund the swamp creatures (like her) use for pet projects or whatever they want. She’s trying way too hard to stay relevant; talk about desperation! We know what will fix the housing problem—start with mass deportations, build+create jobs by bringing back businesses, manufacturing, farming, improving our infrastructure w jobs that pay a fair wage. Stop funding proxy wars, cut govt fat like green new deal, get out of the human/child/drug/arms running business called the UN! Audit the fed, fema, the pentagon, fda, fbi, cia, cdc, dhs, to name a few. Let’s not forget how we are getting ripped off by county appraisal districts who artificially inflate property values thus property taxes (that increase mortgages) & they use to prop up broke school districts, local infrastructure.

Just another buzz word that Democrats use to get elected. They cant stand on their record of skyrocketing interest rates and inflation so they have to make up nebulous terms such as “Junk Fees” and “Price gouging “. Any other reason than poor fiscal policy.

Just like “Our Democracy is at risk” or “Make the Billionaires pay their fair share”

No wonder they are in a full panic when they look at the polls

I believe in a free market economy, but we do not have a “free” market when the Wall Street conglomerates, hedge fund and institutional investor oligopolies with their sophisticated algorithms soak-up the single-family residences (SFRs) with their ALL-CASH offers, treating SFRs as the new commodity investment strategy to either flip or rent. It should be illegal for these corporate oligarchs to compete against the individual single-family owner-occupied home buyer. Period. Congress needs to act.

Housing ownership built the American middle class, but now, especially in the sunbelt states, but we are fast becoming a nation of renters and debtors. This is not because the interest rate went from, say, 4.5% to 6.5%, nor because the price of eggs went from $3.75/dozen to $5.50/dozen, but because the cost to have shelter went from 25% of a person’s monthly income to upwards of 45% of a person’s monthly income. That is unsustainable. Why in such a short period of time did this occur??? Because the Wall Street oligarchs saw the opportunity to commoditize residential real estate. For the first time in American history, the individual buyer had to compete against this Goliath. This created an unlevel playing field. This huge addition to the demand side of “supply and demand” caused the price of housing to go up-up-up. The result was/is a huge imbalance in the SFR marketplace that is only growing.

Excellent point and facts! I’m a Realtor-26 yrs and that is exactly what happened. The percentage of SF homes that were purchased by Hedge Funds and the like is a staggering number in Metro Atlanta and surrounding areas, that drove home prices through the roof. Rents too, yet “landlords” are requesting a potential tenant make 3x rent amount a month. Rent has increased but income hasn’t to that degree. Single family homes became a commodity. I also believe because of Covid and shutting everything down they anticipated a huge foreclosure market again so bought up homes to rent to and “house” the displaced home owners that were foreclosed on, charging exorbitant rent amounts. The price of eggs and gas didn’t cause the decline of housing affordability.

Spot on!!!

Keep a FREE market! That is a fundamental principal of this country, comrade Warren. Hedge funds are NOT buying up the vast majority of SFH in America. That is a myth. The real problem is government has printed money like crazy, hence never ending inflation and the housing prices follow the money. Then they overcorrect by jacking up rates making it so hard to afford to buy. Right now we have a lot more supply than last year, and less demand as people pause until the election is over and wait for more rate cuts.

Yes Lisa, I agree!

Don’t know where you live Lisa but where I live hedge funds and big corporations absolutely have been buying huge numbers of single family homes. It’s not a myth in my market. They target homes in the median and below price ranges with cash offers and the average owner occupant who needs a mortgage can’t compete.

Would you please be specific and list what you consider to be junk fees in both Mortgage and Real Estate transactions.

Lmao. Yes, crack down on small fees here and there that someone has to pay 1 time and can usually get covered..but make sure the keep paying 3k mortgage payments,5-1000 per mo just on property taxes, 2-500 on insurance, 3000 per mo on groceries. 500-1000 mo on gas, 1000 mo for health insurance,, meanwhile having to compete against hedgefunds and banks…50 foreclosures set for auction in my county next month. Last i checked in summer there were 5-10 and we are just getting started folks. Welcome to the american nightmare.