Sen. Elizabeth Warren (D-MA) is leading a group of progressive lawmakers in questioning a Federal Housing Finance Agency (FHFA) directive to the government-sponsored enterprises (GSEs) to count cryptocurrency as an asset for a mortgage.

In a letter to FHFA Director Bill Pulte, Warren – who is the Ranking Member of the Senate Banking Committee – and her colleagues warned that such an action would “introduce unnecessary risks” and “pose serious safety and soundness concerns” in a market that is not designed to accommodate digital assets.

“Under current policy, neither the Enterprises, nor any other channel for federally-backed, insured, or guaranteed mortgages, permit mortgage lenders to consider cryptocurrency when determining whether they can afford a mortgage, unless that cryptocurrency has been converted to US dollars and is accompanied by appropriate documentation,” the senators wrote. “Expanding underwriting criteria to include the consideration of unconverted cryptocurrency assets could pose risks to the stability of the housing market and the financial system.”

The senators also expressed displeasure over Pulte’s conflict of interest in this directive.

“Your order states that ‘each Enterprise must submit and receive approval from its Board of Directors,’” the letter continued. “However, you are the current Chair of each Board, and you have stacked the Boards with members who represent FHFA personnel and your industry allies. While the legality of your appointment as Chair of the Boards is still in question, there also appears to be a serious conflict between your ability to order and approve the Enterprises’ proposals as FHFA Director and to ultimately influence the development of such proposals as Chair of the Enterprises’ boards.”

Pulte did not publicly respond to the letter, which was co-signed by Sens. Jeff Merkley (D-OR) Chris Van Hollen (D-MD), Mazie Hirono (D-HI), and Bernie Sanders (I-VT).

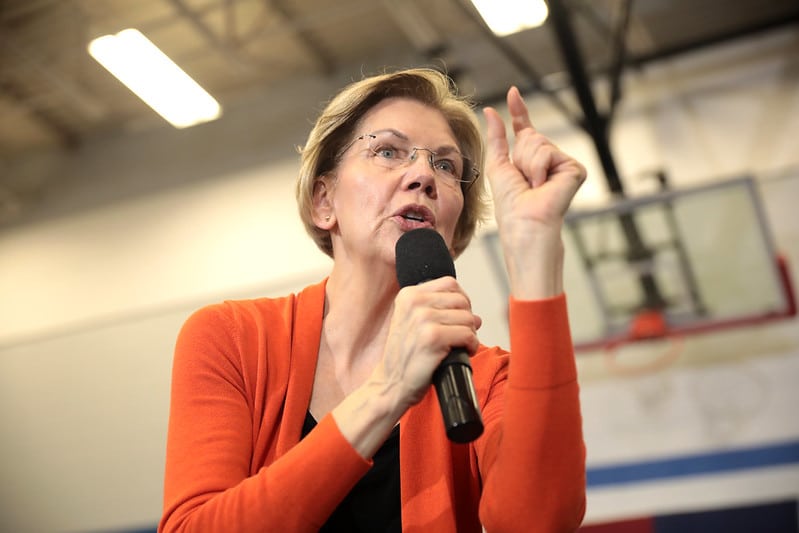

Photo courtesy of Gage Skidmore / Flickr Creative Commons

UNBELEIVABLE ! This is just moving with the time – our firm has closed Crypto sales – time for the government to get with the new reality –

The corruption and self-serving in the tRump administration spreads.

It is so funny that she is corrupt and so are they. We have to remove the parties. They do not have our best interest. Warren made millions on USaid type funding. Same with all of them and insider trading. It is laughable when they call each other out doing the same thing.

Liz Warren is “Heap Big Mad” about this and has no “Reservations” saying so.