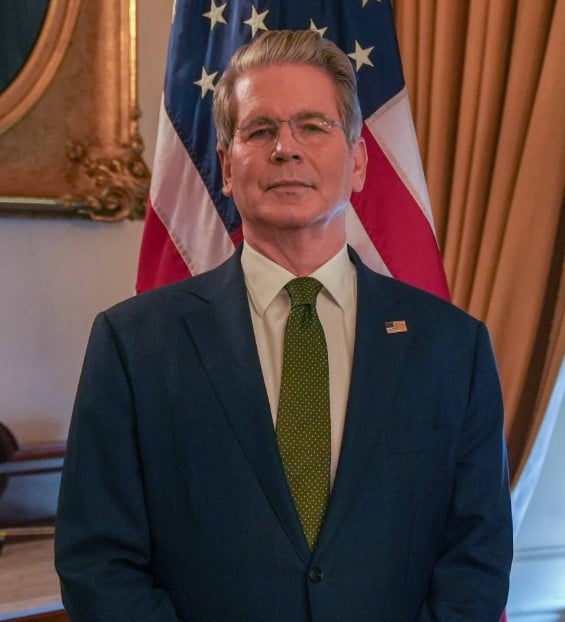

Treasury Secretary Scott Bessent has claimed the housing market was in a recession and the full national economy could potentially slide into a recession due to Federal Reserve policies.

In a Sunday interview on CNN’s “State of the Union,” Bessent remarked, “I think that we are in good shape, but I think that there are sectors of the economy that are in recession – and the Fed has caused a lot of distributional problems with their policies.”

Bessent cited mortgage rates as weighing down the housing market, noting this impacts low-end consumers the most because they are carrying debts rather than assets.

“If the Fed brings down mortgage rates, they can end this housing recession,” said Bessent.

Bessent stated the Trump administration worked to lower the deficit-to-gross-domestic-product ratio from 6.4% to 5.9% through government spending cuts, which should help to push down inflation. But he complained the central bank is not moving fast enough to bring down interest rates, he said.

“If we are contracting spending, then I would think inflation would be dropping,” he said. “If inflation is dropping, then the Fed should be cutting rates.”

There are too many years people that would argue with Treasury Secretary Scott Bessent. in the next meeting a .25 to .50 rate reduction is appropriate. The tariffs are negligible in inflation for now. Federal restraint in spending helps to reign in inflation. While the Federal Reserve can’t go anywhere near what the did during the pandemic the rates still can be lowered substantially to a new normal rate environment.

Lower interest rates will open the door for first time buyers! It’s tough buying your first home for most people.