President Trump made a surprise announcement on Saturday via a Truth Social posting where he floated the idea of a 50-year mortgage.

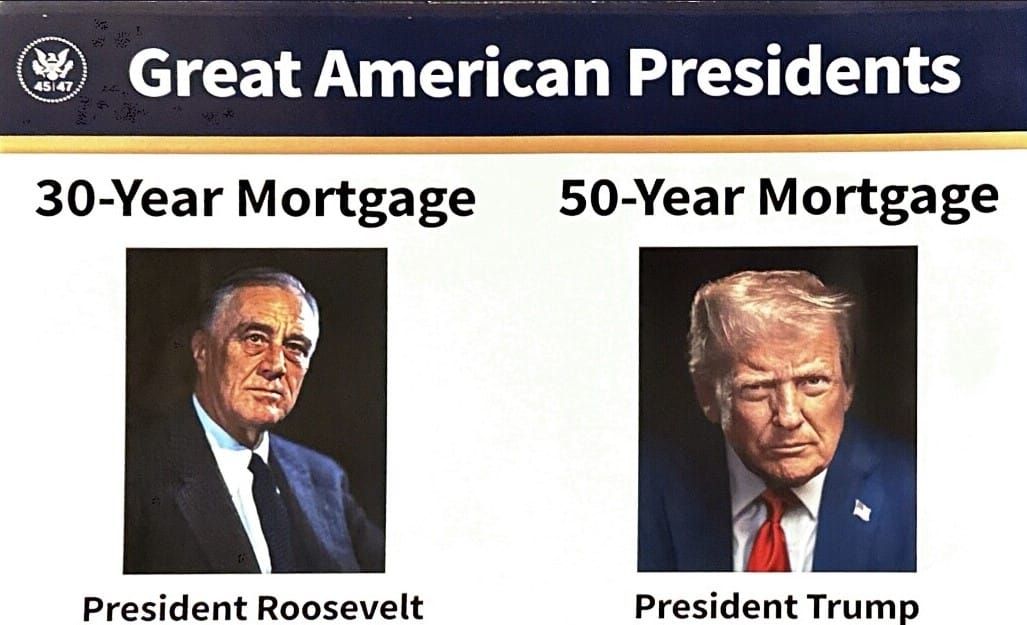

In his post, Trump compared his advocacy for a 50-year mortgage to President Franklin D. Roosevelt’s advocacy of a 30-year mortgage during the Great Depression (see image above). Federal Housing Finance Agency Director Bill Pulte followed up on his personal X account to declare, “Thanks to President Trump, we are indeed working on The 50 year Mortgage – a complete game changer.”

No further details on the plan were announced. Under the Dodd-Frank Act, any home loan with a term greater than 30 years would be considered a non-qualified mortgage – it is uncertain whether the Trump administration would try to unilaterally change that law without congressional input.

The Trump plan received strong pushback from some of the president’s prominent conservative supporters. James Fishback, CEO of Azoria and a frequent Fox News commentator, angrily posted on X, “The “50-year mortgage” is a disgusting insult. We are Americans. We are not slaves. We are not slaves to the plantation owner. We are not slaves to China. And we are not slaves to Wall Street. This 50-year mortgage idea is a spit in the face. It is an insult. We did not vote for this. We did not vote to become debt slaves to private equity firms, the big banks, and Wall Street.”

Rep. Marjorie Taylor Green (R-GA) was also unhappy, writing on X, “I don’t like 50 year mortgages as the solution to the housing affordability crisis. It will ultimately reward the banks, mortgage lenders. and home builders while people pay far more in interest over time and die before they ever pay off their home. In debt forever, in debt for life!”

Carol Roth, former investment banker and author of “You Will Owe Nothing,” weighed in by explaining, “Aside from the sophisticated argument related to the likely debasement of the currency, the 50-year mortgage proposal is a gift to banks at the expense of middle + working class Americans. It creates the illusion of affordability via smaller monthly payments, but with a massive cost: borrowers pay nearly double the interest over the loan’s life.”

And conservative commentator Joey Mannarino opined, “A 50-year mortgage is a horrible idea. I don’t see how that helps the problem. Ban Blackrock from buying homes, maybe?”

Build more houses……that’s the solution. Not hard. Build, Build, Build. Why is that not getting done?

If it were easy everyone would do it. Judy should take a close look at what it takes in planning, resources(including labor), time and money.

I do agree that a 50 year mortgage is not a good idea and will not help to solve the problem. It will only have the result of raising prices.

Worst idea. Sound money policy is needed. Stop printing money and devaluing our dollar. Deregulate. Get government out of the way. And let us own our homes and not be extorted yearly by property taxes.

Not a good idea. No boda will Owes their home in a life time !!!!

Hello, I am a realtor. There is not a lack of housing, there is a lack of affordable housing. Building more, new, the homes are still not affordable. So, there are all types of mortgages available, the key is getting in to a home and the availability to make you monthly payments. Everything went up in price so fast.

Another idea he came up with while sitting on the porcelain throne.

50 year mortgage is completely impractical. It would burden the homeowner for life. There would be an elimination (practically) of resale of homes because the debt would outlive appreciation. Housing would become less affordable. I’d have to assume there would be an increase in bankruptcies when people can’t get out from under the long term debt. Keeping interest rates low and create more housing seem like better answers. I’ve been in real estate for 49 years. The market fluctuates up and down depending on many factors, including inflation, wars, political influences, etc.

Up people’s wages so they can afford to buy a house, put rent control in place

Rent control is a terrible idea. Look at history (E.G. Brooklyn NY). Rent control worsens the problem. Landlords can’t keep up with taxes, insurance, mortgage payments, etc. Result: foreclosures on poorly maintained buildings create a collapse of property values, especially multi-family properties.

Look at history. Those who fail to study History are condemned to repeat it.

50 yr mortgages will lower the payment, however most sell their homes way before that and move on. I doubt anyone with a 50 yr mortgage will see it to maturity.

Yes the final 50 year loan to maturity is outrageous but the monthly payment is about $300 less for the loan vs 30 year on a $500 K loan at 6%. How many loans go to maturity.

Allows for appreciation of a primary asset. Refinance after getting in the game at fewer years or refinance as incomes flourish.

It is a door opener for millions of potential Buyers. It allows for establishing a family in a good environment.

Good to see one person on here who gets what it does. Naysayers should answer these two questions: 1) How much equity to do you gain paying rent? 2) If we are so anti-the slow pay down of principal then why have I.O. mortgages?

If what so many are calling a bad idea gets more people into housing that could not get in otherwise and this is yet another consumer choice why all the fuss? No one is talking away the 15 and 30 year fixed.

Not allowing an added choice for the consumer is essentially saying to the general public – we think your too dumb to make these decisions on your own so we are going to make them for you!

Statistics show that the average American stays in their home for 8-13 years. It’s rare these days that someone buys a home and stays in it for life. Most people move or refi. If it helps with affordability now, there are options down the road and owning is always better than renting. And you can always pay bi-weekly to pay down the principal or pay off and recast. Forget who proposed it and think logically about homeownership.

The only ACTUAL solutions are to build more homes and put more money into the hands of buyers/homeowners. Affordable housing and higher paychecks for the average American. It isn’t rocket surgery, but it isn’t the priority of people living in mansions.

Building IS happening, but the homes being built are for the wealth-gap created new millionaires. Because in a ‘free market’, builders make the most money on homes over $700,ooo. CAN they make money on a $300,ooo home? Definitely, but then they need to build two for every one at the higher price points. There is profit, then there is greater or easier profit. Unless HEAVILY incentivized by government entities, ‘affordable’ housing is just not a priority for builders.

You cannot have rent control, it debilitates an owner from being able to upgrade or even maintain the condition of the home.

You also cannot simply ‘deregulate’. We need smarter regulations, not more or less, necessarily. Mass deregulation is as smart as ‘defund the police’. There need to be standards, and there needs to be oversight. Ever see how bad new construction is in places like Arizona and Texas? Little regulation and the homes are built like trash. Homeowners then have little recompense to get even with the builders, because the scales are heavily weighed in the builders’ favor.

Lastly, as noted in the article, the real winners will be banks and builders. NOT average humans living in the U.S. With a fifty year mortgage, imagine how much the ACTUAL cost of buying a home priced at even $200,ooo would eventually end up being. Is it double? Triple? (Can you tell I’m not a lender?) It is insane to present this policy as something helpful, when the government is supposed to protect us from our own worst inclinations, not push us toward them.

Really bad idea lowers the payment 8 1/2% and doubles the cost of the house solution is to drop rates and drop home prices $40,000 less house will make the average house payment the same as what would be a 50 year loan today

You can’t drop the price of a home when the cost of the materials is higher because of tariffs.

Which is why we need to get more money into the hands of the average American, not worry about lowering the build cost for builders already making billions and hiding behind ‘the cost of materials’.

Eliminating tariffs or impact fees, etc…builders won’t drop prices until people just stop buying, which the wealthy still can (and why those homes still are being built).

A 50 year mortgage isn’t an answer. minimizing how many SFR big business can buy or eliminating their ability to do so as they are consuming homes that will more than likely never be on the market again. Lowering interest rates, building new affordable homes, limited the number of migrants, foreign students whose parents buy homes for them. It’s an accumulation of things causing the housing crisis.

An amortized 50 year loan?

Just say NO!