While the ink isn’t even on the paper yet, much less dry, the recent $418 million settlement offer by the National Association of Realtors (NAR) (which it called an “agreement reached” in its press release) has experienced real estate agents expecting the worst.

That’s one takeaway from a recent Weekly Real Estate News (WREN) poll of our readers. The polling is ongoing, but the results from the first 1,000 agents tell a clear story.

NAR made the offer to resolve the charges brought in the Sitzer/Burnett case.

According to WREN Editor Phil Hall, “The settlement requires NAR to jettison its rules requiring that most residential listings include an upfront offer that informs the buyers’ agents how much they will get paid.”

Hall called the offer a “miss” in his weekly Hits & Misses column. Agents polled by WREN agreed.

Experienced agents expect a very bad industry experience

The settlement offer, which still must be approved by a Federal judge, came barely one month after NAR vowed to appeal the Sitzer/Burnett verdict. In his column, Hall pointed out:

“While some observers are crowing that this will lead to lower home prices, there is a better-than-average chance that NAR’s detractors who pushed for this resolution will unleash the proverbial ‘be careful what you wish for’ situation once the dust settles.”

Agents WREN polled put a similar idea in much more colorful language. One agent told WREN: “I tried for 20 (sic) yrs to make a case for changes in (sic) practice of NAR…only to be (sic) ostracized…Now I am Laughing at them …they brought this on..disgraceful arrogance…”

While not every agent who responded to our survey had 20 years of experience in the business, 79.09% said they had been in the business for more than 10 years. Another 15.28% said they had been licensed agents for 6 to 10 years. Nearly 40% of agents polled said they first heard about the settlement offer on Weekly Real Estate News.

What does their experience in the business tell them about this settlement? Nothing good.

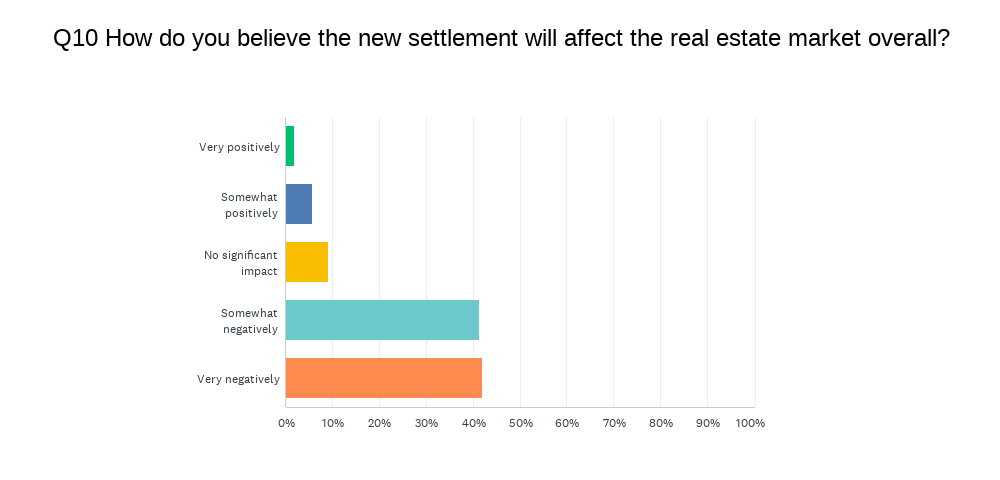

When asked how the new settlement would affect the real estate market overall, more than 83% of agents said it would be negative, with 41.95% expecting it would very negatively impact the market, and 41.40% saying the impact would be somewhat negative. Only 7.45% of respondents felt the impact would be either somewhat positive or very positive.

The risks agents see coming next

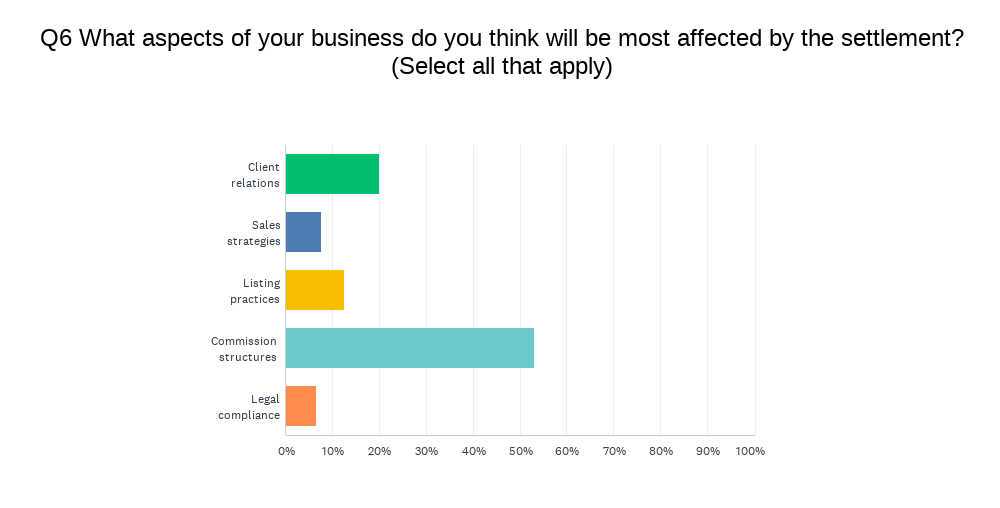

Of the agents surveyed, less than 5% (4.15%) did not expect the settlement to have significant impacts on their day-to-day operations. The rest expect changes, with over 35% (36.57%) saying they expect those changes to be extremely significant. Naturally, most considered their commission structures to be the most impacted aspect of their business.

One in five agents (20.18%) said the settlement would impact their client relations, as well. One respondent said, “The ruling will, in essence, take us back to the stone age of real estate, as things were in the 70s where everyone worked for the seller.”

The agent went on to say: “The evolution of Buyer Brokerage, where each party has their own counsel, is the only way all parties truly are well served. It could and will put buyer brokerage out of reach to the people who need it most: the first-time home buyers who can barely afford their down payments and closing costs.”

While many of the comments from respondents focused on the negative changes they see coming to their businesses and the unfavorable impacts that would have on consumers, many expressed their outrage at their trade association.

“I FEEL LIKE NAR DID NOT PROTECT US AS AGENTS AND BROKERS,” one respondent screamed in all caps. “THEY COULD HAVE FOUGHT HARDER, BUT THEY JUST FOLDED LIKE A HOUSE OF CARDS.”

Our polling will continue and we will bring you new insights from the industry and your agent peers as this story develops and becomes available.

For now, the offer is pending. The verdict in this case came in at $1.78 billion, an amount many commentators called “staggering.” However, Local Logic estimates the potential damages could reach as high as $5.3 billion due to antitrust claims. There is no guarantee, as of yet, that the judge will accept NAR’s offer of 8 cents on the dollar.

Real estate commissions are not set in stone. I have always offered compensation share to another broker who brings a client….Maybe a little less percentage on an easy sale, and more on a tough sell property.

I am not seeing this as a huge disaster…….

Clearly you don’t represent Buyers. Maybe try and think of this from a perspective other than your own.

Help me here Julie. Do you negotiate with buyer on your commission, or do you say, “well, the nar, or my broker, says it has to be 2%? Help me understand.

NAR didn’t protect our rigth , not easy realtors jobs , we work 24 x 7 every days , for adavance the goals of each side , sellers , buyers , lenders, appraisal departments, surveys company, titles Company , tenans , lanlords , and a lots additional areas inside each deal. NAR DIDN’T HAVE OUR AUTHORIZATIONS FOR NEGOTIATIONS OUR JOBS INCOME AMOUNT.

This is either a bot or a foreign entity. A Realtor has the highest standards and can certainly spell and have legitimate sentence structure.

Dedicated Buyers Agents were an invention of NAR, KW, REMAX etc to charge agent agent fees. The list agent brings the property to market – that’s the important agent in the transaction. The list agent is an ethical professional, can represent the transaction and there is no need for a usually a part time inexperienced Buyers Agent from out of town (in my market anyway). That need was manufactured.

I recall when the Buyer Agent side was first coming about. Like most “new things”, it was viewed skeptically but slowly became “standard”.

The seller is in the ultimate control still as it is their house and they have the final word on what they will sell for based on whatever factors are involved for them. Can they be swayed or even cleverly forced to sell for a lower price than they’d prefer to? Or to give in on any other negotiations element? Not really. Their situation may “force” them to but the buyer can’t. Like most things, Time will tell…

I agree. Nothing has really changed except maybe harder pushback from the sellers due to the public perception initiated by corporate media. However, when explained properly by an experienced professional, it should work out for all involved.

Thank you Hank! Why does this WRE continue to print the moan & groan? Unless a broker or agent has been promoting a hard and fast comisson, this is ridiculous! Where are these people coming from?

When you are working with a buyer, in MOST cases, they barely have enough money to close. If they are on any kind of government program to help them buy, then they are even tighter on money. Where do you think they are going to find the money to pay their Realtor?? I recently was in an MLS class discussing this change, The instructor said the buyer would have to pay their Realtor OUTSIDE of the closing if they were using a government program. Now I ask you, do you REALLY think that would happen? They aren’t even allowed to do that by most programs IF they had the money to do so. Yes. Realtors incomes are going to be cut dramatically, and buyers are going to be put in a position where they can no longer buy.

Unfortunately, realtors are thinking consumers really like agents. I was a California realtor and soon I will be a GA realtor. As an insurance broker, the government cut insurance commissions in 2010. Realtors need to understand this: consumers will just as price conscious with commissions just as they are with listing homes too low of a price or buying homes at a price too high. Yes, they may call you back in 5-7 years for round 2. But at the current moment, they want the best deal they can get. Just like in the insurance business, I recommend realtors start contacting people right now. Contact buyers and sellers the right way, not by relying on social media or buying useless leads. Find you a mentor who help you become more confident in introducing yourself to others in public settings.

WHO NEEDS NAR NOW!!!

The last time I checked we still all live in the United States of America. You know, where we have a free enterprise system. 30 years in the real estate business as a Broker-Owner. Real Estate commissions have always been negotiable. I always knew that. I always shared that with my clients. So happy that this wake-up call finally came to this industry. If you are in the real estate business, I say “acclimate”, “be an entrepreneur”, “and use this to your advantage.”

Agree completely! Broker/owner as well and this has always been the case. Commissions are always negotiable with the seller. Maybe it’s time to thin the herds a bit. Get the listing and you will always be relevant.

The disaster does not come from the settlement, the disaster comes from the media pushing lies and saying that the real estate 6% commission is going away and buyers will have to pay their agents 3%. Real estate agents know full well this is a bold-faced lie and there is an agenda being pushed by big government behind the scenes. The only changes that are happening are we will not be able to post clearly in the MLS that there is a buyer’s percentage that may be paid out on listings. It still can be paid out and will be paid out. Business as usual. The other change is that we will be required to have a buyer broker agreement before we show any homes. Which has been and should have been a standard practice already anyways. These media outlets should be sued for false information and misleading the public which in turn is going to make our jobs as agents extremely difficult combating the lies.

What happens if your buyer wants to look at a property, you call the L/A to set up the appointment and find out the commission offered AND the L/ A informs you that there is no commission to S/A?.

CHOICES:

1) Tell your buyer that you are not going to show the house.

2) Tell your buyer that he/she MUST pay your commission

3) Work for free.

Can anyone enlighten me with an answer? BTW, I have been a Realtor for more than 30 years and since day one, they instructed us that the commission was always variable never set as fix.

Exactly. Now Buyers agents will have to do their job!

You are a listing agent. The Biyers agents will be affected greatly.

The current settlement proposal requires a buyer broker agreement. What if a buyer does not want to sign a commission contract? Can they not see a property? I’m sure the answer will be contact the listing agent. It they are obligated to work in the seller’s best interest by law.

I’m a broker since 1980. Buyer brokers better get a 2nd job. Buyers do NOT want to pay the biyer broker. This new norm evolution to reality of paying a buyer broker will take years to comprehend. Welcome to the internet. You’re done. Don’t need you. The key has always been to control the deal…that means being the listing broker.

I’m a broker since 1980. Buyer brokers better get a 2nd job. Buyers do NOT want to pay the biyer broker. This new norm evolution to reality of paying a buyer broker will take years to comprehend. Welcome to the internet. You’re done. Don’t need you. The key has always been to control the deal…that means being the listing broker.

Can somebody explain exactly what they did wrong

Or is it a big secret. What law was broken…in which state.

And who exactly did it

Exactly. We’ve already been down this road. Buyers were underrepresented which is why changes were made to begin with. Now we go back to that? Not sure how this is a positive thing? Plus it really does feel like the NAR sold us short. I guess we’ll see how it pans out.

NAR had no choice. I believe it was setup from the beginning. NAR could not afford $5B judgement, which would have seen a verdict against NAR. Current administration has been dismantling capitalistic occupations since 2021. Whose industry will be next!

I completely agree with you. The real issue is to tear our country down and afterwards the WEF and others will bring in the new world.

EXACTLY

Why are you blaming the current administration? The original lawsuit was filed in 2019, then the DOJ followed on November 19, 2020, what administration was that?

Bingo! Your answer is correct

My guess is that the vacation rental industry is in their crosshairs. There is currently legislation being pushed in Florida that will greatly impair your right to rent your own property short term.

Can you imagine being a listing agent on a desirable property and having 5-8 buyers call you to represent them since they don’t want to pay their buyers agent? How do we navigate this without getting sued by one or more of the buyers that lost out? So awful!!

PERFECTLY PUT! The legal ramifications of this new rule was not well thought through. Time to dismantle NAR for their lack of foresight. According to my calculations, our NAR fees divided by 4 years will increase $70/yr over the next 4 years, in order for NAR to recuperate this loss. Unforced error to say the least.

Ken, the answer to your question is does the Buyers agent have a written agreement with the Buyer? If they don’t they’re right back to how thing were many years ago.

the problem is that the public really doesnt understand how the business operates …..

someone HAS TO REPRESENT THE BUYER AND THEY ARE NOT GOING TO DO THAT FOR FREE–either the seller or buyer pays the listing and the buyers agent — Before the seller paid both selling and buying agent but no one really legally represented the buyer — so it was changed and everyone knew and understood — IT IS IN THE TEXAS LISTING AGREEMENT THAT THERE IS A BUYERS AGENT AND THE SELLER IS PAYING FOR THAT AGENT IN THE COMMISSION PAID TO THE LISTING AGENT — I cant see that there is any simpler way to do it

i really dont understand why and how the lawyers for NAR couldnt make a jury understand that. Either we had bad representation or the opposition were geniuses!!!!!

I completely agree. If explained properly we would not be having this discussion. What happens to VA Buyers now? They are not allowed to pay commissions or fees? Who will represent them? The listing agent? How wonderful. How about the government. What a circus this is turning into.

Marsh, thank you …Thank you….Thank you!….You hit the nail on the head. It’s been like this for some time in many states. As has been said…..NOTHING HAS CHANGED!

If you ask anyone who has ever sold a house, or thought about selling a house, if they would like to get some of the commission back that was paid to a buyers agent, or if in the future they would prefer to not have to pay a buyer commission, I’m quite sure the answers would likely be unanimous on the side of getting money back or not paying in the future. Ok, now please explain how an impartial jury was assembled in the cases that went to trail? Or in any other trial where the jury members have either had a monetary interest where they would have profited, or will profit in the future, based on their decision. In other words, there is no way to obtain an impartial. I think NAR was well aware of the impossible task of prevailing in court, and they made the best deal they could under the circumstances where the outcome was predetermined. I just hope the court accepts the settlement, which is far from a done deal.

It is bothersome to me that all Realtors are going to suffer for the poor/bad practices of a few. What if all of these wonderful lawyers who brought a class action for the action of the few had to face that anytime a lawyer used bad/poor/unethical practices. Just a thought.

Some Realtors will certainly be faced with obstacles but who is thinking about the buyers? A VA Buyer is not allowed to pay commission or fees to the buyer brokerage? Now What? They will be the first to feel this. Start looking for less and less homes willing to take a VA Loan.

Not so Paul. No Realtor that has practiced with an eye toward antitrust violations will suffer. Nothing’s changed, if the Broker or agent has followed the law.

The real estate agent profile will shift to retired individuals with pensions. A retired realtor with a $5K steady monthly pension can work as an agent and accept $5K commission instead of $15K commission at 3%. The retired realtor has the time to pick up $5K, $4K, $6K commissions on $500K or higher homes for sale.

I was a CA realtor and soon will be a GA realtor. Personally, I believe the government will swoop in to take over real estate like the government has done with health insurance.

There will be so many problems. Lawsuits over like dual agency, agent failure to perform because agent ran out of money and could finish the deal, etc.

This ruling will significantly slow down closing because sellers and buyers will now for the lowest commission. Real estate sales will be Amazon’d.

What a possible and nightmarish scenario you just conjured up.

Rick, my friend, you’re not even close to the discussion. I believe you’re a half a bubble off center.

When I began purchasing real estate in the late 1970’s it was definitely buyer beware. Sellers agents would protect their sellers and buyers agents weren’t around. I had real estate attorneys and sellers agents recommend that I not waste my money on title insurance or a survey.(It was amazing what title searches and surveys uncovered and very thankful that I didn’t listen to attorneys or sellers agents) Buyers agents were a welcome addition to the industry.

So right, Linda! Things have changed for the better, but there’s no reason for woe is me, like some are suggesting. Commissions are negotiable, and if NAR demanded, and I don’t know how they did this because I sure didn’t run by business by the NAR, and that’s how it should be.

What are the chances the judge will see this is not good for the buyers at all and will reject the settlement/case?

FSBO sales will naturally increase. I predict sellers will bypass this government influenced settlement and deal directly with buyers.

In California, there was a company around 2010 which helped FSBO buyers with transactions such as looking at paperwork, signatures and getting title and escrow started. The fee was about $1500.

You’ve got 2 different things, Rick. The $1500 companies, I guess were a good thing, but what FSBO’s don’t know is they’re paying for a 3rd party negotiator, who’s familiar with the market and can often much better negotiate a sale. FSBO’s are often unskilled, as they should be since they don’t do this for a living, and often unsuccessful.

The lower income buyers are the ones who will be hurt the most if this ruling goes through. It’s going to make it almost impossible for them to buy a house. It’s hard enough for them to come up with a down payment plus closing costs……now they’ll have to cough up a few more thousand dollars to pay a commission. Come on!!!!!

Get a grip Susie. This ruling has nothing to do with the plight of the lower income buyer.

It is EXACTLY that. We were told in a large Broker’s meeting over the new changes, that the buyers would now be paying for the buyer’s agent, and it would be in writing up front by having them sign the buyer’s representation form. But THE BUYER (never the agent) could ASK if the seller would pay some of their commission in form of a concession. At that point, the buyer’s agent would approach the seller’s agent to ask the seller if they would contribute. They also covered that many first time buyers or low income buyers would no longer be able to afford to buy.

By the way…….where does the seller think the money for their house comes from?…..from the buyer.

WOW..!! So True,.. What a great perception!

Exactly!

As a California Broker, with a six digit license I have been out there for the last 16 years I have been selling foreclosures homes with a commission of 2% and spending many days and hours inspecting and working on the properties. so my commission at the end was much less than 2% But if you expect to get paid by a buyer who is scratching and saving for a down payment and will have to pay a buyers agent a fee. good luck with that, I can see many dual agency that is also not a good Idea. and will open another can of worms. I do not know where these lawsuits came from but it has been always clear the commission is not set but is open for the buyer to know what they are paying and is clear in the listing contract the seller agent will be paid from the commission.

I have heard in the news that this will bring the home value down. just tell your seller that there home is not worth as much as it was , that is just Stupid.

Real estate is not a liquid asset. So that is why the seller pays the commissions to the selling agent and buyers agent. The buyers agent is providing the able and willing buyer to the sale. So all the money (dollars) is being provided by the buyer, so the dollars paid for commissions is actually coming from the buyer. The market determines the price of the home and the buyer knows what he offers is for the home and is not concerned with commissions.

This is how real estate has been sold and commissions should be negotiated between the seller and the sellers agent. Obviously, if you’re a good agent and you negotiate a 6% or 5% commission with the seller you put in the MLS a 3% or 2.5 co broke. Again, if you’re a good agent and the seller negotiates something less the listing agent would cut his commission and the buyers agent who is bringing the dollars would or should still get the 3% or 2.5%!!!

Why isn’t the NAR arguing that real estate is not a liquid asset and without the willing and able buyer real estate cannot be bought and sold.

Well Said!

A breath of fresh air, Jon. Nothing’s going to change and if done properly, there’s no antitrust violations. If the NAR did require a 2% posting in the MLS, and an unknowing agent or broker followed it, they deserve to be sanctioned. Did they forget comissiong are negotiable?

Hi Jon, you said it right. I am an agent with over 20 years of experience. I see two issues here:

1) The lawyers that brought this lawsuit should be investigated. Many times I get these offers in the mail to participate in a mass settlement and I will get like $1 or $2 and if lucky less than $10. These lawyers make huge amounts bringing frivolous lawsuits and get paid so much, LOL.

2) I live in the San Francisco bay Area. The standard here is to price the house low, expose it well and take offers on a given date to attract multiple offers. The market dictates the price. How the lower commission will bring the price down? LOL, Multiple offers.

3) Nobody can force me to work with a particular buyer. SO, if I am the listing agent I will disclose that I am already working with another buyer and can not represent more than one buyer. We have paperwork to protect ourselves. Full disclosure.

4) People do not realize that to be a buyer agent requires lots of work. Start with the pre qualification process, then showing houses, then writing offers that often times do not get accepted, and if accepted finding home inspectors, etc etc. Lots of work. I do not like representing buyers anyways, too much work, I don’t like to drive around showing houses, I am a listing agent, I make sure my listing shows well, price it right and buyers will come. What will happen is that buyers will try to have the listing agent help them and again, the listing agent will select the best buyer and work with him. But again, I don’t like the responsibility of representing buyers on my listings, hard two serve two masters, don’t like it.

5) Maybe they will place a new rule that listing agents if asked must write offers, well, back to square one, I will tell the buyer to get me all the paperwork needed, pre qualification letter, proof of funds, disclose that I am writing several offers, and present to the seller all the offers and let the seller work with the best buyer. I do that now anyways, if the seller hires me I do not betray the seller nor the buyer. The seller will choose the best qualified buyer that most likely will close the deal.

6) In summary: The winners of this lawsuit are A) the lawyers that brought the lawsuit,

LOL, B) The Listing agents and c) Maybe the seller because I might lower my commission if I will be double ending but I am not sure about this, because I am not going to take a huge responsibility to help two parties for the same money. It will depend on the deal. But anyways, I already do this, on my listings I tell the Seller that I will lower my commission if a buyer comes along asking me to represent them. LOL.

I always protect myself, full disclosure from seller, buyer must inspect the house, buyer removes contingencies, etc etc. In my 20 plus years of experience my clients , the sellers have been sued in two cases, and in both we went to court and won, Full disclosure save my clients, the sellers. LOL,

People do not know the bunch of disclosures and paperwork that we have to do to List a property for sale and for buyer agents the same. We have the best contracts on earth, We earn or buck.

Sorry guys for such a long list of items but this is reality. This is it, I will not waste my time anymore on this, I just say, Bring it on. LOL

The judges and attorneys do not know how real estate works. We should have them be a real estate agent for a month and see what they say afterwards.

They wouldn’t be able to handle it.

This is one of the most ridiculous rulings I have ever heard of ! I have been in the real estate industry for over 40 years and can remember a one page contract and one page listing agreement. Now we have to be responsible for a 17 page contract and 13 page listing agreement and are expected to figure out how to be compensated for all that work I dont think so ! 3% only goes so far ! It will get back to the buyers having to go directly to the listing agency to see properties, as it once was when I first began selling. Dont think I will hang around for that to happen again with all that WE are responsible for !

Well said, Sandra, but I doubt it will go back as it once was, unless a buyer knows nothing about real estate. Remember, the listing agent owes their loyalty to the seller and a savvy buyer might not want this, and go with a Buyers agent. i bought a vacation home some years ago, and, as a licensed agent for 30 years, I purposefully worked with the listing agent. When we made an offer, I made it a point to tell the listing agent, “Well, if this one doesn’t work, we’ll just try the other one. What do you think he told the seller?

I’d like to see the nar go under at this point. Something would rise from the ashes.

A breath of fresh air, Jon. Nothing’s going to change and if done properly, there’s no antitrust violations. If the NAR did require a 2% posting in the MLS, and an unknowing agent or broker followed it, they deserve to be sanctioned. Did they forget comissiong are negotiable?

What is the downside to continuing business like usual. I go take a listing at a commission I’ve been used to for years and explain to the seller the advantages of offering a substantial part of that commission to a buyer’s agent? The total commission is on the listing agreement like usual. The amount to the buyer’s agent, which is a part of the listing commission will not be put into the MLS. I would think that a buyer’s agent would want to know about this. It can be communicated other than the MLS, for example email or text or other ways. I can visualize, as a buyer’s agent, identifying properties to show and texting or emailing (or other ways) the listing agent to ask if the seller is willing to pay the buyer’s agent. I’m saying that the big change is this buyer’s agent’s fee paid by the seller through the listing broker cannot be communicated in the MLS. The other change is there must be a signed agreement between the buyer and buyer’s agent. We’ve been doing that in Tennessee for years. First of all most sellers are used to paying the commission through many years. Why assume such a gigantic shift unnecessarily. It seems to me to be unlikely that agents are going out and listing for a listing side commission suddenly and expecting the buyer to pay the buyer’s agent. Just continue as usual and communicate the buyer’s agent fee paid by the seller other than on the MLS. This doesn’t seem like the huge deal it’s being blown up to be. Just another step when you have a buyer to find out how much a seller is willing to pay for the buyer’s agent’s commission. Sounds like a lot of folks are listening to hyped up news and not thinking this thing through logically. I’m an owner broker and this is my 50th year straight in real estate sales. I got my license in March of 1974. Tell me what I’m missing please.

Is it possibility that we all can stop paying the NAR and start something new? Florida is pro transaction broker. NAR sold us all out and the big media machine loves to make us all look like sleazy lawyers. They are making us battle uphill on our reputations.

The VA buyer (Military Veteran) is going to be at a greater disadvantage as in the past they have navigated relocating to unfamiliar cities or states, potentially facing exploitation by car dealerships or furniture stores. Now, they face the prospect of purchasing homes valued at around half a million dollars without adequate representation. This situation echoes the broader struggles of less affluent home buyers, including first-timers, who must muster considerable upfront funds to secure a property. This is reminiscent of how wealthier individuals have the advantage of “School Choice” by choosing homes in better school zones due to their financial capacity.

Moreover, the role of experienced and educated real estate agents in representing buyers is becoming increasingly challenging. Despite the common rebuttal that clear explanations can mitigate these issues, the reality is that listing commissions, inclusive of the buyer’s agent’s fees, are highly sensitive to market fluctuations. In particularly active seller markets, a single photograph of a property can attract a swarm of buyers, thanks in part to platforms like Zillow, which aggregate MLS and FSBO listings. Unfortunately, this ease of access doesn’t translate to a comprehensive understanding for first-time buyers, who may end up purchasing homes with unforeseen problems. Imagine a FSBO offering a 4% fee to buyer’s agent, nothing for a listing agent and being a bigger percentage of the market thanks to dot coms!

The notion of listing agents as dominant forces in the market faces challenges from non-REALTOR agents who approach, propose and POACH an active seller with significantly lower commission rates, threatening the traditional model. This competitive landscape is further complicated by the increasing viability of FSBO transactions, spurred on by FSBO websites aiming to bypass listing agents and the MLS.

The debate extends to the ethical guidelines set forth by the REALTOR Code of Ethics (COE), which, while not legally binding, has historically promoted ethical behavior within the profession. The departure of agents and major brokerages from REALTOR organizations raises questions about the future conduct of those no longer bound by these ethical standards. As the industry stands on the cusp of significant change, the implications for all parties involved—be it through increased FSBO transactions, shifting brokerage models, market conditions or evolving professional ethics—remain to be seen.

Does anyone remember the break up of AT&T (MCI, Sprint, and other Baby Bells evolution). Should I remind the younger crowd that a 5 min conversation NY to LA in 1980 $2.17 (about $8 in today’s money).

This business of selling real estate works in many ways. I suggest you buy stock in Zillow, Homes.com, etc,….you don’t see them being sued.

I am Seth Tuttle SR. in Erie PA,

I am proad to obtain my licence in 1978 and I have worked as an agent and investor in real estate since 1977 and I love this carreer choice and I have no desire to retire. There is no better carreer in my opinion. We halp people acheicve a major step on the ladder of the American Dream!

We have been hood winked. The DOT.COMS obtain the fruits of out labot and then offer us leads for 20% to 30% and some comapanies pay that fee. Stop supporting them! They don’t pay us for our product! To top it off, Realtor.com, ours, for some reason, was sold! That was our only chance to beat these sites at their own came

NAR gives them our product and we don’t get a dime. Name one other industry where the store gives away the product to the the advertiser who then wants 20% to 35% of the gross. They sould be sued, but wait, they lobby! In a big way. Why on earth did NAR sell Realtor.com? Who got the benifit of that give-a-way?

Buyer agents are going to suffer deeply, however more importantly, buyers will be exposed if they won’t pay for the services of a professional. The attorneys will soon be knocking on the door of Zillow and Homes.com becaue they have huge profits! Good!

I remember the CEO of Zillow on one of the morning talk shows years boldly proclaiming, “they aren’t in the real estate businness. That was their toll to attract the traffic.” We gave them the information under the directive of our leaders at NAR. Why? Now they demand to get a piece of the commission via memberships, loan referrals, service providers and a closing agents fees ….. their profits are the result of our efforst!

They don’t meet people evenings and weekends, negotiate anything. solve the problems that arise in the transaction, and educate the buyers to the possible issues with a property and the hurdles we go through to make sure the client get the best terms on the financing end.

When will NAR take a stand to represent their members’s interest and stop demanding we give away the store?

NAR will have to merge with something else, be replaced, or just dissolve in the future.

The uproar and issue is the media reporting false news. The ruling or settlement is not really impacting a major change. It just prohibits listing agents advertising a buyer agent fee on the MLS platform. It can still be advertised on any other media site. Unfortunately the media is again public enemy number One by spreading lies and rumors. They have the power to influence the entire nation which is happening right now by them pedaling false news saying that the 6% standard commission is going away. Basically translating to sellers that they will get a 50% cut in commission and make thousands more on their home and translating to a buyer that they will be paying their agent themselves out of pocket. For one 6% isn’t a set standard. That is just an industry average and is and has always been negotiable. Number two a buyer has always been responsible to pay a commission if a listing agent or seller is not offering out compensation which is a very rare occurrence. But we all know most buyers do not have thousands of dollars extra to pay an agent because they are responsible for their own down payment and closing costs. More and more buyers are first-time home buyers and the younger generations do not have a huge savings and are just getting started. The doj has stuck their big nose into a national system that has been functioning quite well and is now pushing their agenda and having the media spread false news to the general public for them. Now us agents around the United States will have to combat all of the lies and have uncomfortable conversations with hundreds of millions of clients around the nation. What an absolute mess the government has created once again

100% correct

I am thrilled to see this change! I never thought it was right that the Seller paid for the Buyer’s representation & always felt each party should pay for their own representation. I see this as an absolute win for the consumer. Also, I don’t understand why, after being licensed by the State & regulated by TREC, it was mandatory to be a member of NAR to join the MLSs.

So how can all the Buyer Agents unite and ensure that a Federal Judge will not approve the current ruling?

That will not happen and the ruling is actually pretty good if you fully understand it.

In California, technically, the seller doesn’t pay the buyer’s agent, the listing agent does. The total commission is negotiated between the seller and the listing agent and the listing agent agrees to share some of that commission with the buyer’s agent. In the listing, the total commission isn’t disclosed, only what the listing agent will share with the buyer’s agent which is usually half. The seller isn’t paying it, the listing agent is. In the area where I live, there has not been a 6% commission for a long time. It is generally 5% or a flat amount which is typical for manufactured homes or low priced properties. A buyer’s agent should always do what is best for their client but they want to know what they will get paid.

It seems there are a ton of agents that are not very well informed on this. If this ruling is approved by the court in July, it states that sellers, listing brokerages and buyers can all pay the buyers agent. The only big change is that said compensation cannot be advertised in the MLS. That just adds one step to the process. It is not a huge ordeal. The other requirement is that prior to showing buyers a home you must have a buyer representation agreement. That does not mean you need to force them to work with you or you with them. Just that they understand you are representing them in the possible purchase of that home and you have certain fiduciary responsibilities to them. It will be up to the buyer if they want to see homes where the seller or listing brokerage are not paying a fee to the buyer agent, and where they will be responsible for that fee. Most homes will have the fee paid for by the seller or listing brokerage.