The Canadian investment firm Brookfield Asset Management announced plans to expand its presence in Japan with the combined $1.6 billion purchase of a stake in a Tokyo mixed-use complex and a large open land plot for logistics development.

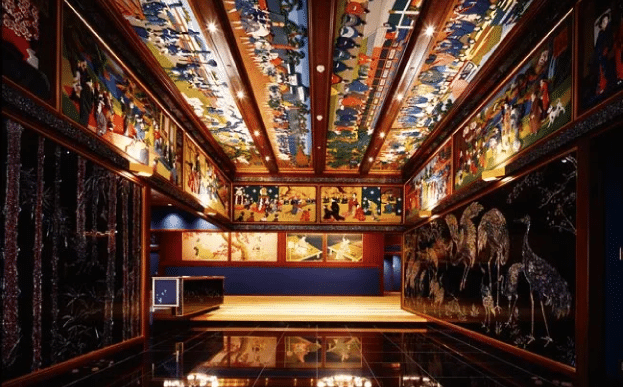

The Japan Times reports the company acquired a stake in Gajoen, which encompasses a 60-suite room luxury hotel with banquet halls and restaurants, and two office towers. The property is owned by China Investment and LaSalle Investment Management, and Brookfield plans to take over the asset management of Gajoen and invest in renovating the public spaces for the hotel and offices. Brookfield did not disclose the level of its ownership stake in the property.

Brookfield also acquired a 1 million-square-foot parcel near the manufacturing center of Nagoya, where it will spend about $300 million to develop a 2.4 million square-foot warehouse. The property is based near a highway between Tokyo and Osaka.

Andrew Burych, a managing partner and head of East Asia real estate for Brookfield, added that the company is considering transactions with public Japanese real estate investment trusts that are trading below their net asset value, and with private REITs whose shareholders might have liquidity needs.

“You’re going to see us doing a lot more in Japan,” said Burych in an interview. “Our pipeline is pretty good going into 2025.”

Photo courtesy Hotel Gajoen