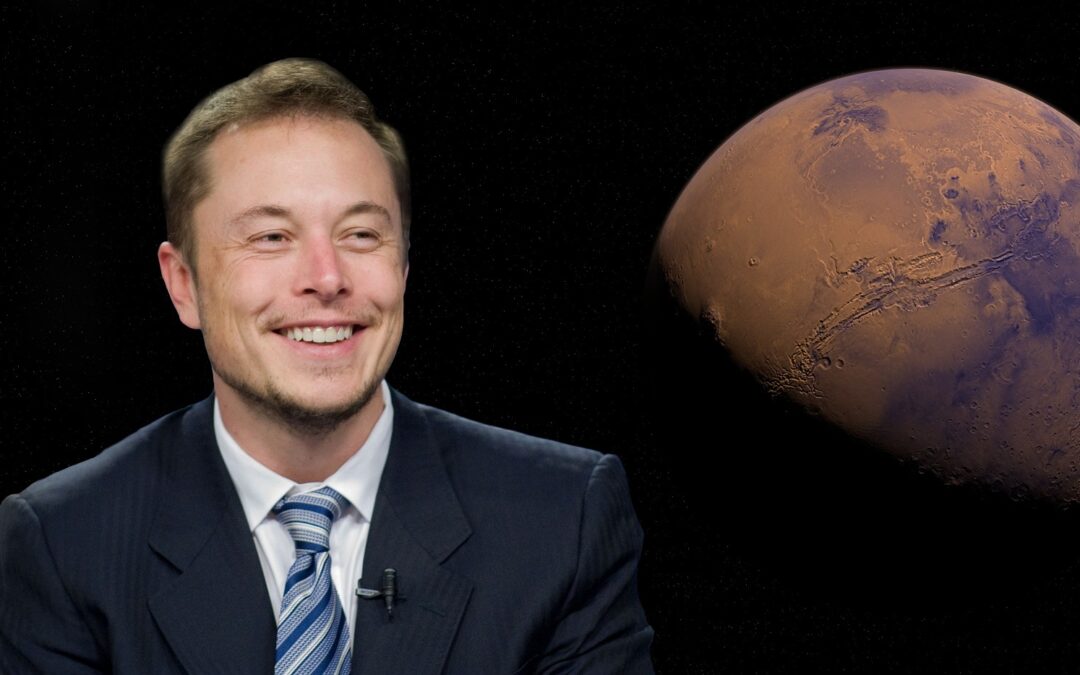

American homeowners did not receive a vote of confidence from Elon Musk, who predicted the nation’s home values will be collapsing sooner rather than later.

The Tesla (NASDAQ:TSLA) chieftain offered his doom-and-gloom prophecy on Twitter in response to comments made by David Sacks, the Craft Ventures founder, regarding the state of the commercial real estate market.

“Commercial real estate is melting down fast. Home values next,” Musk tweeted.

Musk began to jettison his residential real estate holdings in May 2020 when tweeted he was rethinking his “attachment to the material world” and will be “selling almost all physical possessions.” Within a month, Musk sold most of his $100 million real estate holdings and relocated to a $50,000 prefab home in Starbase, Texas, near the headquarters of his company SpaceX.

Twitter reaction to Musk’s prediction was mixed. Conservative commentator Mike Cernovich responded by tweeting, “Home prices may fall but people were doing too much flipping into higher cost homes anyway – which was driven by real estate agents and propaganda. Unless there’s massive job losses (possible), then even a mid term home price decrease won’t have much impact.

Tech entrepreneur Brian Krassenstein was more skeptical, tweeting, “Not in Florida. Things have leveled off but have barely dropped. Thank you boomers.”

Portland-based realtor and broker Shawn Yu thought Musk had it half-right, responding “Commercial yes, homes not so sure.”

And Zach Milburn, co-founder and CEO of Nomad Development Inc. in Raleigh, North Carolina, tweeted, “No. Completely different category. A third of US homes are paid off and many if not most have fixed rates sub 3.5% Add to this, we have an oversupply of office. There’s a massive under-supply of homes.”

Maybe commercial real estate should be converted into residential housing since pandemic opened the remote work option or even 4 day work week. More people are using residential space for some kind of work related endeavor. Can commercial real estate be turned into coop or tenancy in common. Tenancy in common was prevalent in SF during the early 2000 boom.

Interesting proposal.But do people literally want to live at work. The line between home and office got even more blurred during the COVID-19 pandemic. This has impacted many things including personal autonomy,voersonal privacy and work-life balance. I think many more people will opt for going into business rather than continuing to be wage slaves

Musk is technology genius. People doubted him but he proved them wrong on high quality, high cost EVs and the world’s appetite for such a vehicle. Housing market specialist? Not so much! Other than owning residential real estate and subsequently selling all of it, I am not convinced he has the knowledge to forecast an imminent “meltdown” of the housing market. Unfortunately he will scare many young followers to continue renting which will have an ultimate long term impact on their wealth building. Step 1 of creating wealth is to own your own home and start building equity. Get out of the wealth inhibiting rent cycle. From there, investment properties, stock market and other investments. Side note, Musk is still one of my favorite entrepreneurs of all time, however will have to pass on this suggestion of a meltdown or any near term softness in residential real estate. Low supply, high demand = positive movement in values. Kevin R Kieffer

Commercial could be turned into senior living. Malls for example. They can walk there, have their own space. No weather elements to worry about. Have a cafeteria etc. make it like a little village.

The way for new assisted living as well.

Brian Krassenstein Is no expert. This article lost all its credibility

agree on your comment Shawnie

I am sorry Elon I disagree, but I am your fan, and love your car. To those of who are renting I always recommend my clients if you see a house ur mortgage is close to your rent payment & you can effort it, don’t think about. BUY IT……