MOrtgage News & Insights

View top national motgage industry news articles, advice, insights, and more. Subscribe to UpdatesMost Recent Mortgage News

Get the top headlines in local and national mortgage industry news today in the articles below. Do you have news you would like to contribute? Submit a guest post here. To receive weekly updates on the top mortgage articles in your area, subscribe for free today!

Guest Opinion: MBA Chief Broeksmit on the Election and Housing Policy

MBA President and CEO Bob Broeksmit considers housing policy after Election Day. Continue Reading Guest Opinion: MBA Chief Broeksmit on the Election and Housing Policy

Forecast: Mortgage Origination to Reach $2.3 Trillion in 2025

MBA predicts mortgage rates will reach 5.9% by the end of 2025. Continue Reading Forecast: Mortgage Origination to Reach $2.3 Trillion in 2025

New Click n’ Close Loan Program Aimed at Rural Markets

The new product is designed to aid homebuyers with down payment assistance, with availability in select markets. Continue Reading New Click n’ Close Loan Program Aimed at Rural Markets

Mortgage Application Activity Up 7.1%

The refinance share of mortgage activity increased to 31.6% of total applications. Continue Reading Mortgage Application Activity Up 7.1%

Mortgage Rates Dip, But Still Close to 7%

The 30-year fixed-rate mortgage averaged 6.88% as of March 7, down from last week when it averaged 6.94%. Continue Reading Mortgage Rates Dip, But Still Close to 7%

Why This Housing Market Is Not a Bubble Ready To Pop

Source: Keeping Current Matters --- Homeownership has become a major element in achieving the American Dream. A recent report from the National Association of Realtors (NAR) finds that over 86% of buyers agree homeownership is still the American Dream. Prior to the...

Liens and Encumbrances Affecting Real Property Ownership

By Dan Harkey Real Estate & Private Money Finance Consultant m: 949 533-8315 | e: [email protected] What is a Lien? A lien is a legal right or claim against real property, referred to as a security interest. The lien is given or conveyed to a creditor (lender)...

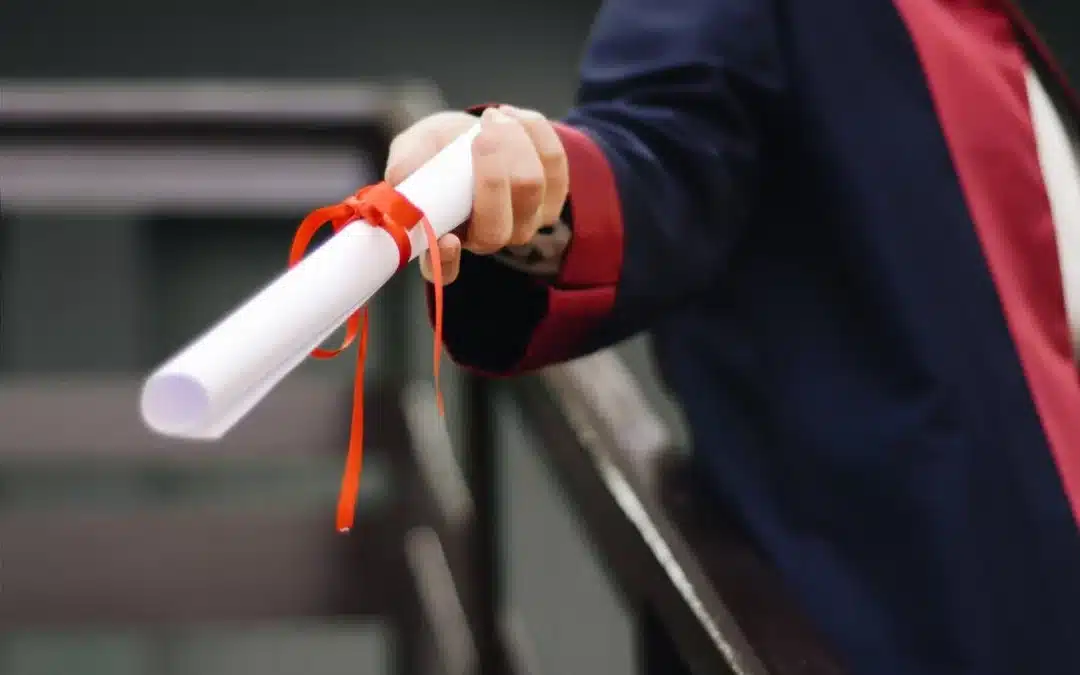

Homeownership by Education: Degree-Holding Owners Surge as Those Without High School Drop 30%

Source: Housing Wire --- Although there are 4% fewer owned homes in the United States than there were in 2010, an increasing share belongs to highly educated people. And, with Millennials cementing their status as a driving force during the last decade, the life...

Nearly One-Third of Homeowners Have a Mortgage Rate Far Below Today’s Level, Prompting Some to Stay Put

Source: Redfin --- About half (51%) of U.S. homeowners with mortgages have a mortgage rate under 4%—substantially below today’s level of 5%. About one-third (32%) of all homeowners—including those without mortgages—have a mortgage rate under 4%. With rates now at...

FHA adds 40-year loan term to COVID-19 arsenal

Source: Housing Wire --- The Federal Housing Administration told mortgage servicers that they can now offer a 40-year loan term as a COVID-19 recovery option. Servicers for FHA-insured mortgages can offer the modification immediately, according to the latest update to...

How To Buy A House With Little Or No Money Down

Source: Forbes --- For many homebuyers, saving up for a down payment can seem like a massive roadblock, especially with home prices skyrocketing. But there are mortgage options designed specifically for those who can’t save the standard 20% down of the loan amount—or...

4 predictions for the housing market in 2022, from economists and real estate pros

Source: Market Watch --- We asked home and mortgage experts and economists what they predict will happen in the housing market this spring and further into 2022. Here’s what they told us. (You can find the lowest mortgage rates you might qualify for here.) Prediction...

How do you buy a house when you have a house to sell

Debbie Bloyd is a contributing author to Weekly Real Estate News and can be contacted at 469-768-0337 or [email protected] How do you buy a house when you have a house to sell – need to pay off bills and it all has to be done now!!!! And why is it...

Homebuying Frenzy Continues Despite Obstacles

Source: Banker & Tradesman --- Wits’ End would make an appropriate name for a new subdivision in today’s wild housing market. While there’s not yet such a place on the map, many would-be buyers are quickly running out of patience. Their frustration is not...

Reverse Mortgage: Could Your Surviving Spouse Lose the House?

Source: Investopedia --- If your spouse took out a reverse mortgage and you aren’t on the loan—or if you know someone in this situation—you need to understand what rights you have and what rights you lack. Reverse mortgage laws for non-borrowing spouses can be...