MOrtgage News & Insights

View top national motgage industry news articles, advice, insights, and more. Subscribe to UpdatesMost Recent Mortgage News

Get the top headlines in local and national mortgage industry news today in the articles below. Do you have news you would like to contribute? Submit a guest post here. To receive weekly updates on the top mortgage articles in your area, subscribe for free today!

Mortgage Rates Remain Flat

Fannie Mae predictied mortgage rates will end 2025 and 2026 at 6.4% and 6.0%, respectively. Continue Reading Mortgage Rates Remain Flat

Mortgage Application Activity Inches Up Again

The FHA share of total applications decreased to 18.7% from 19% the week prior. Continue Reading Mortgage Application Activity Inches Up Again

United Wholesale Mortgage in AI Partnership with Google Cloud

UWM will integrate Google Cloud AI and machine learning tools into its lending platform. Continue Reading United Wholesale Mortgage in AI Partnership with Google Cloud

Start-Up to Offer Continuing Education and Training for Mortgage Professionals

Next Level Education was co-founded by longtime mortgage industry professionals JR Huber and Debbie Gadberry. Continue Reading Start-Up to Offer Continuing Education and Training for Mortgage Professionals

VA to End Mortgage Rescue Program for Veterans

Mortgage Bankers Association President and CEO Bob Broeksmit criticized the decision. Continue Reading VA to End Mortgage Rescue Program for Veterans

Q1 Mortgage Origination Activity at 23-Year Low

On the refinance side, only 407,956 mortgages were rolled over into new ones – the smallest amount this century. Continue Reading Q1 Mortgage Origination Activity at 23-Year Low

Mortgage Application Activity Continues to Decline

There was less interest from borrowers for purchase loans and refinancing. Continue Reading Mortgage Application Activity Continues to Decline

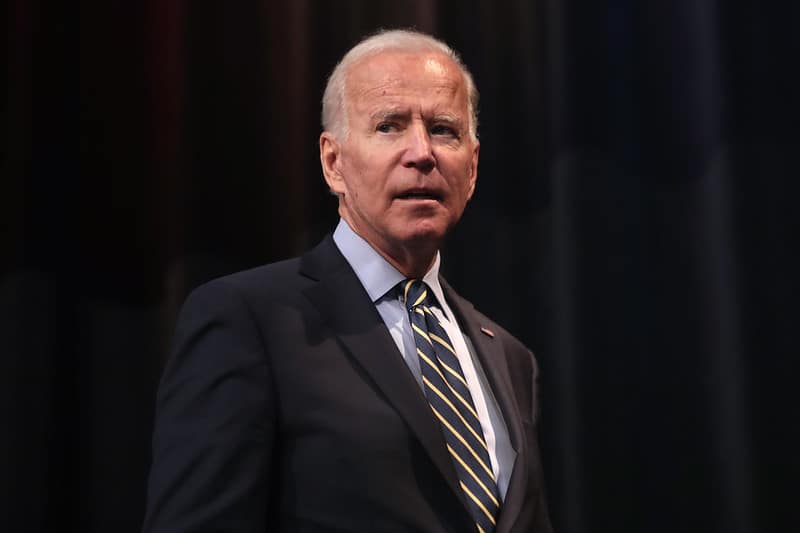

GOP Governors Call on Biden to Rescind LLPA Changes

“Only the Biden administration would think it can solve a supply issue by subsidizing demand and bad credit,” said Missouri Gov. Mike Parson. Continue Reading GOP Governors Call on Biden to Rescind LLPA Changes

SouthState Bank Launches Fund to Help LMI Borrowers Achieve Homeownership

To finance the fund, SouthState allocated $10 million that will be drawn from over a three-year period. Continue Reading SouthState Bank Launches Fund to Help LMI Borrowers Achieve Homeownership

UK Homeowners Facing Mortgage Rates Over 5%

Unlike the U.S., mortgage borrowers in the U.K. are required to renew mortgages on a cyclical basis. Continue Reading UK Homeowners Facing Mortgage Rates Over 5%

Colonial Savings Exits the Origination Space, Focusing on Mortgage Servicing

The company’s origination business has its roots in Fort Worth Mortgage, which was founded in 1952. Continue Reading Colonial Savings Exits the Origination Space, Focusing on Mortgage Servicing

Mortgage Rates Go Up, Up and Away

The national median mortgage payment during April was $2,112, an 11.8% spike from $1,889 in April 2022. Continue Reading Mortgage Rates Go Up, Up and Away

Mortgage Delinquency Rate Crashes to a New Low

No state posted an annual increase in overall delinquency rates in March. Continue Reading Mortgage Delinquency Rate Crashes to a New Low

Mortgage Application Activity Sinks Amid Economic Tumult

“We have yet to see sustained growth in purchase applications,” said MBA’s Joel Kan. Continue Reading Mortgage Application Activity Sinks Amid Economic Tumult

Mortgage Delinquency Rate Bounced Up in April

Foreclosure starts dropped by 23% to 25,000, the lowest since September 2022. Continue Reading Mortgage Delinquency Rate Bounced Up in April