A total of 2,619 down payment programs were active during the fourth quarter of 2025, according to a new data report from Down Payment Resource (DPR). While the total count is five programs fewer than during the third quarter, it is also 6% greater than the 2,466 programs active in the fourth quarter of 2024.

DPR found these programs provide approximately $18,000 in benefits on average, resulting in an 8.8% reduction in a homebuyer’s loan-to-value ratio. Many of these programs also help cover closing costs, prepaid expenses, mortgage rate buydowns and reductions in mortgage insurance costs.

Every county has at least one down payment assistance program in the fourth quarter, and more than 2,000 had 10 or more. By state, California has the most with 353 programs from 223 providers, followed by Florida has 196 programs from 128 providers and Texas has 128 programs from 63 providers.

DPR also found benefits and home income caps rising, with 1,599 programs (62%) providing an average income limit exceeding $100,000 across the program’s footprint. Additionally, 270 programs (10%) did not have income restrictions, a 15% year-over-year increase.

Slightly less than two-thirds of these programs (63%, or 1,639 programs) were open to first-time buyers, up by 8% from one year earlier, while 980 programs (37%) were available to repeat buyers, a 3% year-over-year increase.

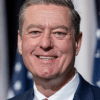

“Affordability will remain the defining challenge for homebuyers in 2026, and down payment programs are one of the most practical tools lenders have to address it,” said DPR founder and CEO Rob Chrane, who added lenders that incorporate these programs into their origination output “are better positioned to turn qualified demand into sustainable homeownership.”

I’m very glad to see the increase in the down payment assistance programs, it’s a great way to help out first time home buyers and the younger generation!

no, its not a good thing

Watch out for these programs. ask me why..

Real Estate Agent, please tell us why?