Sen. Elizabeth Warren (D-MA) has introduced a $550 billion plan to fund the construction of approximately 3 million new housing units by raising estate taxes.

Warren’s endeavor, dubbed the American Housing and Economic Mobility Act, encompasses a wide range of pledges and goals that include the lowering of rents on low-income and middle-class households by 10%; the investing of $445 billion in the Housing Trust Fund to build, rehabilitate, and operate nearly 2 million homes for low-income families; the investing of $25 billion in the Capital Magnet Fund – to be leveraged 10:1 with private capital – to build more than 750,000 new homes for lower-income; and the investing of $4 billion in a new Middle-Class Housing Emergency Fund to support the construction or acquisition of homes “where there’s a supply shortage and housing costs are rising faster than incomes.”

Furthermore, seeks to rewrite federal rules related to the acquisition of single-family homes by private equity firms and expand the Community Reinvestment Act (CRA) to include nonbank mortgage companies.

The bill envisions the allocation of $550 billion to finance its goals. To fund this plan, Warren stated her bill “returns the estate tax thresholds to their levels at the end of the Bush Administration and sets more progressive rates above those thresholds.” However, she did not specify if she was referring to the George H.W. Bush presidency or the George W. Bush era.

“The only way to dig our country out of this housing crisis is to build more housing so everyone has a place to call home,” said Warren in a statement. “My bill will make bold investments in our country’s housing and encourage local innovation to lower housing costs even more — and it’s all paid for by getting America’s wealthiest families to chip in.”

A companion bill was introduced in the House of Representatives by Rep. Emanuel Cleaver (D-MO).

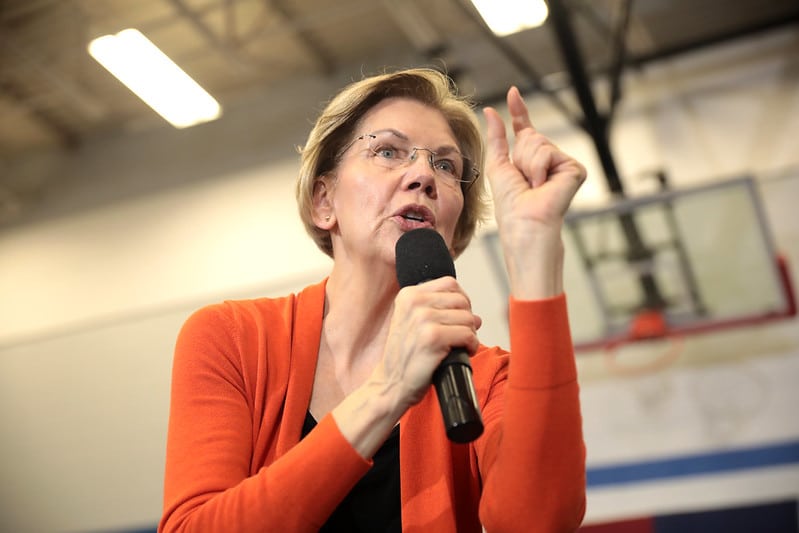

Photo: Gage Skidmore / Flickr Creative Commons

As long as undocumented immigrants are not included in this bill. Only American citizens would qualify for this bill.

Look at who’s sponsoring this bill. You don’t really think she will exclude them, do you?

“Atlas shrugged “

Elizabeth Warren is really onto something here. Let’s tax people even more because… why not? Such genius thinking on her part. In fact, maybe the government should just take all our money and then decide where the biggest need might be and fund it, since they really seem to know what is best for us. That would be the Kamala world. Taxed, taxed, taxed.

Agreed!

If that crazy plan of hers passes the billions would become ‘lost’

in the paperwork and the American people would be duped again.

Since it is Warren’s idea, I am surprised she did not require the new houses to be teepees in honor of her native american ancestry. Teepees would be less costly and increase mobility as they are designed to be portable..

Don’t forget – we are a country of immigrants. What our legislators need to do is to stop subsidizing everything and start creating more jobs. There was a time when it meant something to be an American. We were proud to pay taxes, because it meant we were contributing to the growth of our country, this sense of entitlement HAS to stop! Little Joey next door shouldn’t be rewarded with a free ice cream Sundae after he spent all his money on bubble gum, when I saved up my lunch money to be able to buy an ice cream cone. So, it follows that if you work hard and save, you might some day reach The American Dream of owning a home. I shouldn’t feel bad that you live in an apartment when I see you going off every weekend for a mini ski holiday with your friends. You, in turn shouldn’t expect the government to build you an affordable home, especially if it means that the government is going to tax the estate that I worked hard to create, while you’ve whittled away all the money in your estate, so not only have you played the life of a playboy, your estate is worthless, so it cant be taxed to pay for the home that you feel that the government should build for you…Does this seem fair?

Oh, and by the way, Warren’s plan is really lopsided, because the estates that are going to be taxed are those of the remaining Boomers and Gen X. These are the folks who have “worked for a living”. The estates of the Millenials and Gen Y, the folks who have much more money from spending five hours a week doing a podcast as a “social influencer”. These guys don’t red to worry, because the tax laws will change again in 20 years to raise the ceiling on the value of a person’s estate. It’s kind of like a punch in the gut – Warren wants to tax our estates to give hand outs to people who shouldn’t have a house if they can’t afford to pay full price, and she’s also part of the group who robbed the Social Security Trust to pay for their needless programs, which have not raised any jobs – just the opposite, More and more Pepe in America want free handouts. Want to go to college for free? Sure. We don’t expect anything back from you. Wanna take 8 years to graduate? No problem, we’l forgive your student loans. And they are ding all this without printing money, issuing US Treasury Bonds or “raising taxes”. Yea, sure. I’d rather have some immigrant from Brazil, trained as a medical doctor and willing to work at McDonalds and pay his taxes, so someday he can become a citizen, living next to me than someone born here and has such a sense of entitlement to al the good things that I have worked so hard for.

Just sto and think about it for a minute, you self entitled biggot,

She and her cronies are out of their minds-We have to get these people out of government —

Here is how it works: The “newcomers” are going to get the housing. Once they are logged into their new homes they will enjoy free everything. Housing. Food. Education. Cash for expenses. Health care. And since they are now participating in our economy, ,not on the contributing end, but on the receiving end, they will also be able to receive driver license, formal ID, and of course the most important thing, the right to vote.

While for most Americans the economy has remained stagnant, the wealthy have benefited enormously since Covid arrived. Sen Warren is proposing a mild but important change that would bring some inherited wealth back into circulation. This will level the playing field a bit, and deserves the support of all of us agents who have their clients’ best interests at heart. Bravo!

Your band aid is misapplied. First, stop the United Nations from funding illegal immigration into our country which consumes housing. This fact has been documented by the Epoch Times documentary on the subject. Secondly, the wall street money deployed by Blackrock, Vanguard, Open House, and other private equity funds to purchase single family homes are outspending John and Jane Sixpack for the existing houses. At least you have mentioned this elephant in the room. Presidential candidate Robert Kennedy has pointed this out. Finally, the biggest elite families put the second to die’s estate into one or more foundations used by that bloodline to fund other charities over which they have sway. The estate tax mechanism is a poor revenue source; go ahead, you will increase the demand for estate tax professionals to prepare estate freezes for our clients. More money for us.

The federal government should not be building and owning affordable housing units! They should pass laws to help private businesses and housing authorities build and own affordable housing units just like the LIHTC law already in place. But expand the existing law to allow higher density in existing homes, include non-family members to allow other friends and even help immigrants find rooms at LIHTC properties.

I built and own 192 units designed 100% for folks making 60% of AMI and have a 10% vacancy due to restrictions. I should be 100% leased with waiting list but restrictions make it too difficult.

Expanding eligibility and density will solve huge demand with existing supplies!!!! Don’t just spend money to build more units!

There has to be some requirement that only citizens of the USA can be beneficiaries of this new boon doggle. I don’t think it will work and just cost too much to administrate. Do something with illegal immigration instead and we probably wouldn’t have a housing problem.

I am so glad you put that on writing .

Did you that some want to rent because of no responsibility.

If they feel like paying rent they will buy most of the time they or late ,short or do not pay at all. I was landlord my opinion

Drop interest rates and you’ll see new build starts increase, then people can also move up to the next level houses and it opens it up. Keep government out of building houses for people, this is not Europe. Then they will want 50% of your income.

No. More. Democrats. These people are evil. Their platform is hate, death, pedophilia, mental illness, communism and more hate.

We the people? No name? No credibility. Just Coward.

How about stop wasting taxpayer dollars on unaccountable loans to Ukraine and wherever else.

Those in construction and mgmt will benefit

How about the billions and trillions we send overseas for useless endeavers and wasted wars. As a family we always take care of our affairs at home and make sure we good stewards before taking care of others abroad.

More taxation isn’t the answer. Adjust estate taxes sure but don’t send it all to foreign aid. Pinch it from foreign aid. Americans pay enough government poorly spends.

Good idea. Can we start by shutting the money spigot currently flooding Israel?

Coud also get us out of the genocide business.

Meanwhile she lives in a 5000 sf single family near Harvard and has just 2 people in her household . Why doesn’t she convert her house to a 2-3 family and rent the other units to sec 8 tenants in cambridhe where there is a shortage

NIMBY

We are a democracy not a socialist society

To all the morons against the government taxing the wealthy to provide affordable housing for the middle class, this may come as a shock to you, but I sincerely doubt those who commented here with your negative comments, YOU are NOT that wealthy 1% that she wants to tax. This sounds like a very positive plan

Calling people morons for having an opinion that differs from your own is a HUGE part of the problem in our country. It is ok to agree to disagree. It is NOT ok to pass such harsh judgment on your fellow citizens. People like you are the reason that the lines of division remain deep.

Jean: YOU are the idiot here!

You should complete more research on this one!

You insult good people. Do you really understand estate tax? The Gov. takes half of someone’s estate and the heirs have to split the remaining half. I have four kids, so the Gov. gets four times as much as one of my children. If that happens I think I can terminate Gov. people or people like you who want to steal my lifelong Hard work.

Jean, you better wake up. They will be taxing everyone that owns real estate or assets to pass down to their children. They are in it for the future votes! Please wake up!!!

I am open to discussion. But let’s keep our language, civil and courteous.

The government is always the source of problem if they involve, I am pretty sure it will getting worse.

Let’s not continue to burden taxpayers when funds can be reallocated for initiatives such as these.

$550 billion plan to fund the construction of approximately 3 million new housing units equals $185K per unit. Not is CA, NY, FL, most places where someone wants to live, or MA where she is from. LA just proposed building new low-income condos at $1M each. They need to et together nd figure out how they can build them so cheaply. And that $185K does not take into consideration the other $105B not used for constructing new homes.

We have 50 separate states to try out ideas first before imposing them on Everyone at the federal level. Let Sen. Warren try this idea first in MA and see how it works. People are already fleeing the state for many other reasons. Lets see if this helps there.

Smaller landlords trying to make a difference like Fred will only be hurt by additional regulations. Maybe look at regulations that are inhibiting or adding unnecessary costs to building?

Lots of offices and some government buildings are sitting vacant. Maybe some incentives to repurpose them?

Shelters without sprinkler systems or arc-fault circuits are still better than the tent encampments found in many cities.

Entrepreneurs always find a better way.

Get government out of the way, don’t let it be the only way at our expense.

You are 100% correct Charlie. Congress has delivered a $35 trillion deficit to the American people and no accountability. Entrepreneurs will always do a better job because their livelihood depends on it unlike the government. That’s why capitalism works when government stays in their lane.

This is a typical uninformed, mis-guided, un-educated politician spending $ we don’t have expanding government into areas where free-enterprise should provide the solution. Although the intent is noble (we desperately need affordable housing), this is not a reasonable solution. We are all so tired of the government over-reach into our lives and pocket books. We’re excessively taxed our entire lives and then they want to tax what we’ve worked hard to save for our future generations. Please -give us a break.

Another nut job politician penalizing people who have worked hard and made sacrifices to own a home by making them pay for other peoples homes. When will the government figure that the government is the problem? Idiot.

I just can’t help feeling that anything proposed by Democrats will fail.

“Government is not the solution to our problem; government is the problem.” (President Ronald Reagan at his First Inaugural Address on January 20, 1981)

Of course we need more housing, it’s mainly for the illegal immigrants that are still pouring into our Country. Keep the damn government out of the housing business and impeach Warren.

This buying up of single and multi family homes by big company’s /LLCs/investment co.s has caused this price/inventory crisis…

This is the govts goal to make smart cities where “you will own nothing and be happy. The New World Order” by 2030.

Why is it that we cannot even keep a home in the family and pass onto the next generation? Because of taxes and the rules and regulations of the all mighty govt enslave us all…

Except for the puppets in our govt who sell their souls to steal from we the people.

Wake up this will be your grandparents or parent home they will come after… as you try to hold onto the family compound… you and I will be forced to sell due too the high cost of Everything.

Every Little Bit Helps … we all know what it’s like to be 3 or 4 deep in a chain where it only happens when the 1st time buyer, or the starter home sells so the chain can close. It’s been a while since I’ve been 4 deep, with so many cash buyers keeping the starter buyers at bay, and the lack of inventory. New MLS rules and market corrections may bring stacked closings back.

‘ Finding Suitable Housing’ clauses have appeared more often the past couple months.

Taxing the wealthy should be a given in this Country… but they’ve maneuvered themselves Tax Breaks unfair for the incomes they generate … the Middle Class should get Tax Breaks First.

djt brags about not paying taxes, ( that makes him smart) then bankrupts 6 Casinos and Resorts.

There are all the other businesses he bankrupts and strains because he doesnt pay his bills… these include Trump Shuttle Inc when he defaulted on loans, Trump University which ceased operations amid Lawsuits and Investigations (of his Business Practices), Trump Vodka, Trump Mortgage llc, GoTrump.com (a travel site) and Trump Steaks have all ceased operations.

Do you think he took Tax Write Offs for shuttering these Companies and putting employees out of work ? The 1st time and Low Income Buyers are the People who need a tax break, and a chance to buy their 1st home. Home ownership brings wealth for the move up buyer.

Anything to start the chain again, is fine by me.

Government is too big. They never ceae to find ways to spend OUR HARD EARNED MONEY. The government takes our money to give as they see fit. Our estate is to give to our heirs, not for government to take and disperse. Politicians get rich in government. That’s why they never want to retire. Please spread the word. Tell your friends and family how important it is to vote. Vote on common sense, intelligence and merit. Vote who is best for this country to serve us, citizens of the US. These millionaires can donate more of THEIR OWN MONEY if they want. Stop taking from us hard working people. No hand outs. Work hard and earn your own money.

Raise the poverty level by teaching people how to raise their energy level. Any neural scientist will tell you that. Then they can dig themselves out.

Things like this sound good until you have an understanding of the internal workings of government. In order to build, maintain and operate these units they will need to set up a new entity. The new entity will require personnel (with government benefit package) offices (with space, equipment, utilities, etc.) in DC. AND redundant entities across the country. This new bureaucracy will have a yearly budget which increases every year in perpetuity. It will be inefficient by nature because the primary goal of its administrators, managers, and employees will be self preservation of the entity and increasing its budget. There will be no incentive to innovate or conserve costs and resources. They will spend lots of money on outside consultants and analysts and invest tens of thousands on tailored software that doesn’t work. The actual mission of building, maintaining and managing housing units will rapidly become secondary to the care and feeding of the entity. This is the reason the government can’t solve problems. Not to mention the fact that what’s needed and what works is different in various parts of the country. More big government is not the solution, if you don’t believe me find someone who works for the government and ask them about how their agency is run. Every word I said is true and sadly Elizabeth Warren and her colleagues have no clue.

Raise estate taxes? Well…

1) Before taxing the “the wealthy” be darned sure your estate doesn’t qualify as

one of, “them”! You may be surprised at how fast inflation will make you, “wealthy”.

2) How many times does a family pay estate tax on exactly the same asset?

As often as the valuation of the estate is greater than the estate tax threshold at DOD.

3) Pay property taxes while you own your home, Capitol gains on your home if sold before

you die, Estate Tax on your estate after you die and another round of capitol gains

tax paid by your heirs if/when they sell what’s left.

Meantime, our kids are living with record inflation, a sagging economy, increasing estate valuations , and rising taxes. They can’t possibly earn/save/plan their way through this level of (runaway) taxation.

Anyone potentially within striking range of inheritance tax exposure should consult with a reputable CPA and financial advisor, regularly.

And whether Democrat or Republican… poor, middle class or “wealthy”…

It is in the public interest to VOTE inept/pandering politicians out of office.