A new platform that promises buyers the ability to purchase a home with a mortgage as low as 2% has begun operations.

The start-up Roam uses the mortgage assumption process where the buyer will take over (or assume) the existing mortgage terms from the seller. All government-backed loans are eligible for assumption by law.

“Assumable mortgages are one of the most undervalued assets in America,” said Raunaq Singh, founder and CEO of Roam. “We started Roam as a way for homebuyers to take advantage of the assumable mortgage opportunity and increase access to affordable rates so that more Americans can realize their dream of homeownership.”

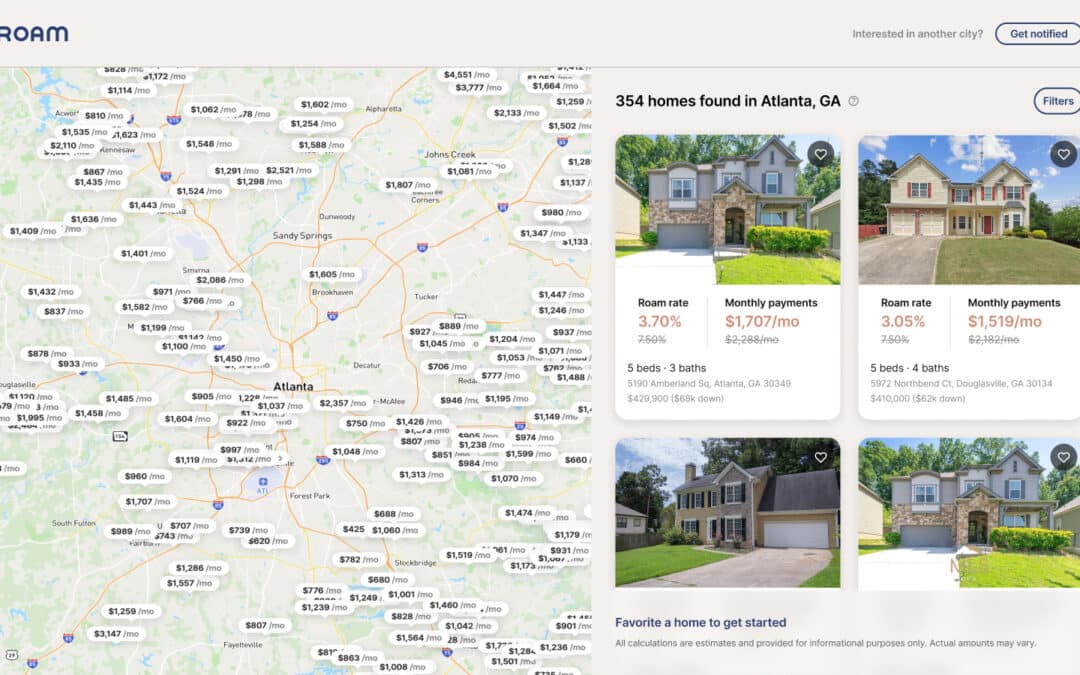

Roam advertises listings to qualified buyers through its website, which is the only platform for buyers to search for homes with an assumable mortgage today. The company claims that Roam buyers can save up to 50% on monthly mortgage payments compared to buying a home with a traditional mortgage at today’s rates.

Roam’s service is currently available in Arizona, Colorado, Florida, Georgia and Texas, with plans to expand into new markets soon.

The company has also secured a $1.25 million seed round led by Keith Rabois at Founders Fund, with additional investment from Opendoor co-founder Eric Wu, Culdesac CEO Ryan Johnson and #ANGELS Founding Partner Jana Messerschmidt. Rabois and Wu have joined Roam’s board and the company hired Tim Mayopoulos, former CEO of Fannie Mae, as a senior advisor.