President Trump has provided a broad hint at his plans for privatizing Fannie Mae (OTCQB: FNMA) and Freddie Mac (OTCQB: FMCC).

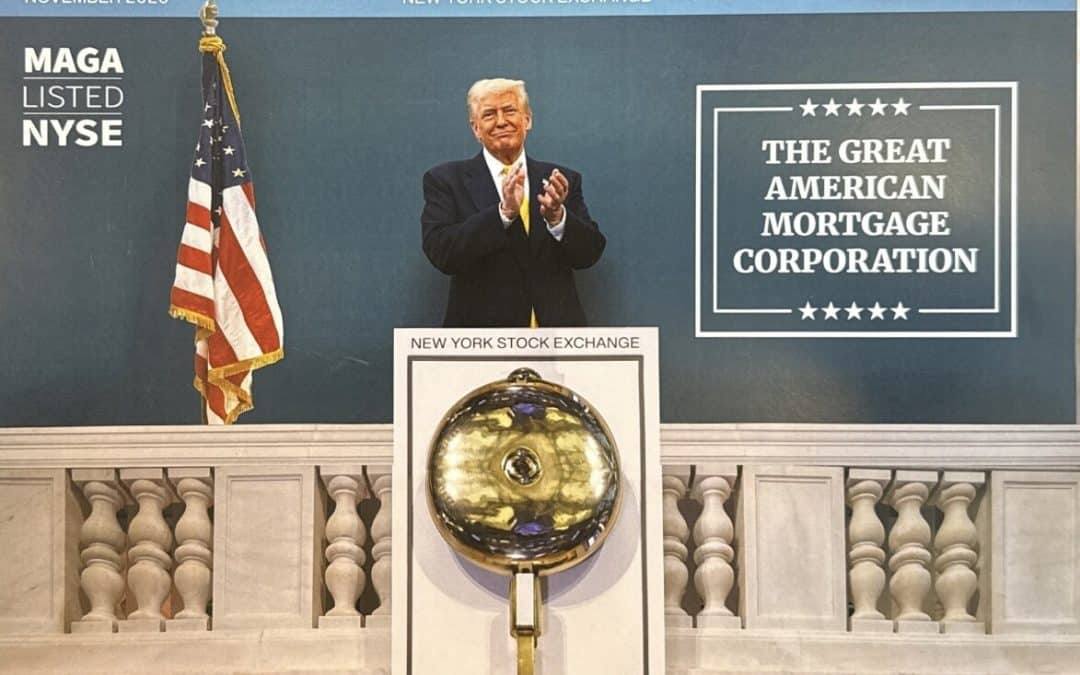

In a posting on Truth Social, the president posted an AI-generated photo showing him at the opening bell of the New York Stock Exchange, with a sign reading “The Great American Mortgage Corporation.” The title of the photo reads “November 2025 – New York Stock Exchange – MAGA Listed NYSE.”

The posting had no text to explain the photo, although the imagery would suggest “The Great American Mortgage Corporation” could become the new name of a merged Fannie Mae and Freddie Mac. However, Point Bridge America First ETF is currently trading on the NYSE with the “MAGA” ticker. Point Bridge is an exchange-traded fund that tracks the performance of the Point Bridge America First Index, which is composed of US companies whose employees and political action committees supportive of Republican candidates for federal offices. It is unclear whether that ticker will be ceded to “The Great American Mortgage Corporation.”

Trump has recently met at the White House with several chief executives at major banks, including JPMorgan Chase’s Jamie Dimon and Bank of America’s Brian Moynihan, to discuss strategies for the privatization of Fannie Mae and Freddie Mac, which will be observing their 17th year in federal conservatorship next month. To date, no specific plan for the conclusion of the conservatorship has been put forward.

What could go wrong with a mortgage purchasing giant, selling stock with the guarantee that if something goes wrong (bad investment decisions) that the Federal Government would bail them out. No risk for anyone but the taxpayer.

This is one time when I feel the President is making a big mistake. In the past, the gov. always raided the extra funds from FNMA to balance the budget or pay for something out of the ordinary. No more of that.

FNMA’s approval is needed before a new loan product can be sold. Who will monitor that?

FNMA is the #1 watchdog against fraud and loan mishandling. Who will monitor that?

Having it be just another stock offering doesn’t do the mortgage world one bit of advantage. If anything, it will be a complete disadvantage……….says a person who has been in the mortgage industry for the past 40 years!!

the one time?

From Bill Ackman via X

One way to reduce mortgage rates would be to merge Fannie and Freddie. A merger would enable them to achieve huge synergies both in their operations and in the trading price and spreads of their MBS, savings which could be passed along to consumers in the form of reduced mortgage rates.

A merger would also reduce the cost and risks of government oversight as there would be only one institution that would require FHFA oversight

The next step after merger will be to severely restrict FHFA oversight or do away with it entirely, just as this admin. is rolling back other regulations & oversight.

Deregulate, privatize and watch the corruption follow. We will be heading for another 2008 scenario

Do we really need to see or hear every thought that this guy has.. Why not do the due diligence with financial experts who can point out cause and effect scenarios.? Him meeting with a few in his own circle, aka the banking executives, does not represent an unbiased strategy group.