President Trump took to the lectern at the World Economic Forum in Davos, Switzerland, to deliver his much-promoted speech designed to outline his administration’s efforts to encourage affordable homeownership. However, the speech offered no new ideas and gave the impression that the president did not want home prices to go down.

Housing was among multiple subjects raised in an often-rambling presentation that zigzagged between issues including Trump’s demand for US ownership of Greenland to insults against political rivals including former President Biden. When it came to housing policy, Trump’s talk seemed more emotional than policy-centric.

“I am very protective of people that already own a house, of which we have millions and millions and millions,” he said. “And because we have had such a good run, the house values have gone up tremendously, and these people have become wealthy. They weren’t wealthy.”

Trump then added, “They’ve become wealthy because of their house, and every time you make it more and more and more affordable for somebody to buy a house cheaply, you’re actually hurting the value of those houses obviously, because one thing works in tandem with the other.”

Oddly, Trump then cast himself as having the disruptive powers, stating, “Now if I want to really crush the housing market, I could do that so fast and people could buy houses. But you would destroy a lot of people that already have houses. In some cases, they’ve mortgaged their house and the mortgage would be very low and all of a sudden the mortgage without any changes becomes very high and they end up losing the house.”

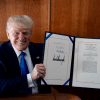

Trump pointed to his new executive order designed to curtail institutional investors that acquires single-family homes from accessing federal guarantees and incentives.

“Homes are built for people, not for corporations,” Trump said. “America will not become a nation of renters. That’s why I have signed an executive order banning large institutional investors from buying single-family homes. It’s just not fair to the public. They’re not—they’re not able to buy a house.”

However, the executive order does not ban institutional investors from the housing market – such an action would require an act of Congress. Nor does the order clearly define “large institutional investors” – although it directs Treasury Secretary Scott Bessent to come up with definitions for “institutional investors” to create parameters for this new initiative. The executive order does not impact investors whose acquisition financing is not guaranteed by Fannie Mae and Freddie Mac.

Trump made no mention of another proposal he recently raised that would enable homebuyers to tap into their 401(k) accounts to fund a down payment. That would also require an act of Congress to become law.

Once any government speaks of fixing housing prices, we should be afraid. Since it is step one in crushing the free market. Housing prices fluctuate based on supply and demand, interest rates, inflation and the reason someone is selling or buying. It is not the same as selling apples. For all intents and purposes investors should stay out of the single-family market with the exception of those who purchase to fix and resell. They should enjoy the profits they work for. Buying single family homes to the create a rental portfolio is the issue. These homes come out of inventory and restrict the number of properties available for purchase. You could say the ownership of single-family homes by these large investor groups now being used as rentals helped cause the housing shortage and the quick increase in prices. Finding a way for these large investors to return these single-family homes to the marketplace is a bit tricky. It will take years to accomplish, which is fine, since they would need to slowly divest so that no one is hurt by a sudden change in supply. Again, if Government forces liquidation, it will drive prices down since supply would have a sudden increase. We walk a slippery slope here and need to be smart with how the real estate industry is governed. It must remain a free market in order for all to enjoy the benefits of ownership. By the way, the large institutional investors should concentrate on developing desirable rental communities that would be acceptable to those who need or want to rent including many senior homeowners who see no present option except to stay in their homes even if they no longer want to own. There is plenty of opportunities, we just need to look for them.

Trump is an idiot. He changed his mind before the reporter left the room.

Trump doesn’t know what he is rambling about. House prices are determined by supply and demand. However, in order to get more 1st time buyers to buy their home, the high rents that institutional investors charge need to be rent controlled.

Same as the war on drugs which we have been loosing for decades. The only thing that will work is to take away the demand, then the supply will dry up. In order to take away the demand, is to lock up drug users, offer them treatment, if they refuse, keep them locked up. And the drug pushers should get long sentences.

The price of homes and number of investors went up because the interest rates were held artificially low even after the recovery was near complete from the great recession. As you’ll remember, they’d begun to raise rates before Trump was sworn in. Trump was elected and he wanted to heat up the economy, so he struck out to lower rates.

Investors saw an opportunity to purchase with such a low interest rate that money seemed free. Homeowners bought with the intention of refinancing every year or two to pull equity out as market prices surged upward. Now you have home owners in a bind because there hasn’t been the surge in home prices in the last 2 years. They can’t pull equity out to pay off their credit cards. Investors are seeing rents drop. Remember average homeowners income didn’t rise at the same rates that home prices did.

The elephant in the room that no one is talking about is private credit. When buyers couldn’t get a regular bank loan, they went to “hard money” private credit loans which were fast and properties and borrowers weren’t properly vetted. That’s how so many “cash” offers were deceptive. Buyers could offer cash knowing that they had a “hard money” loan that they could close in days. We don’t know what the delinquency rate is in private credit because it is so unregulated. The money invested in private credit lending by individuals and banks is a significant portion of their portfolios.

Covid was fake and so is pricing. Stop screwing with the markets. DROP THE PRICES

I’m totally fine with barring large institutional investors and foreigners from buying any more single family properties to hold as rentals. The best way to increase housing supply in the short term is to deport illegal immigrants. They all live somewhere, and every unit occupied by an illegal (possibly with government subsidies) is a unit that could be made available to an American. Less demand means rent prices and home prices would moderate downwards. I don’t want a crash, but rents and prices are still way too high in many places. I say that as a homeowner and landlord in SF bay area.