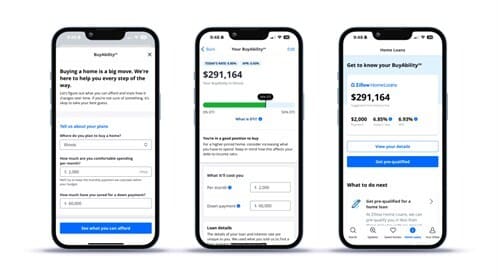

Zillow Home Loans is rolling out BuyAbility, a tool designed to addresses what homebuyers can afford.

According to the company, BuyAbility can provide buyers with a personalized, real-time estimate of the home price and monthly payment that fits within their budget, and then gives insight into the likelihood of qualifying for a loan. BuyAbility is powered by real-time mortgage rates from Zillow Home Loans.

Buyers can get started on the Home Loans tab on Zillow’s app. A shopper’s BuyAbility calculation will update regularly with changes to mortgage rates and their credit score, the company added.

“What many people don’t realize is that your mortgage rate is highly dependent on your credit score,” said Orphe Divounguy, senior economist at Zillow Home Loans. “The better your credit score, the lower the rate you’ll qualify for, potentially saving you hundreds of dollars a month. BuyAbility is personalized to a buyer’s credit score, income and down payment, and updated regularly to reflect current mortgage rates, giving home shoppers a true understanding of their buying power. BuyAbility is a great starting point for buyers who may be hesitant to look under the hood of their finances or share personal details with a loan officer.”

Zillow Home Loans is an affiliate of Zillow Group, Inc. (NASDAQ: Z, ZG).