A proposed sales tax hike to finance Denver’s affordable housing, a bumbling response to Hurricane Beryl and too many empty offices in San Francisco. From the wild and wooly world of real estate, here are our Hits and Misses for the week of July 8-12.

Miss: Rocky Mountain Low. A big thumbs down goes to Denver Mayor Mike Johnston for proposing the addition of an extra 0.5% to the city’s current effective 8.81% sales tax rate as a vehicle to finance his affordable housing plans. Johnston, a Democrat, claimed this new tax would raise an estimated $100 million a year that would be used for affordable housing development, along with paying for more housing vouchers, bridge loans for construction projects and other housing initiatives. Really, is jacking up the sales tax the only way for the city to build affordable housing? Hopefully, voters who would be stuck with bigger bills – literally and figuratively – will push back at this dum-dum proposal.

Miss: How Not to Respond to a Crisis. Earlier this week, Hurricane Beryl crashed into Texas and created several fatalities while leaving millions of people without power. But President Biden didn’t issue a major disaster declaration until a day after the storm made landfall. Biden told the Houston Chronicle the delay was because he was “trying to track down the governor to see—I don’t have any authority to do that without a specific request from the governor.” But Abbott, who was in Asia on a business trade mission, took to X (formerly Twitter) to refute that, tweeting, “Biden’s memory fails again. Not once did he call me during Beryl. He has my number & called me on Memorial Day after tornadoes hit Texas. I’ve had daily calls with state & local officials during Beryl. I spoke with FEMA Admin while on our trade mission but Biden never called.”

Miss: I Left My Office in San Francisco. One of the most depressing commercial real estate stories this week involved a new report by CBRE that found San Francisco’s office vacancy rate soared to a new record high of 37% during the second quarter. However, San Francisco Federal Reserve President Mary Daly offered empirical evidence that better days are just around the proverbial corner. “Every week I come, traffic is getting worse – that’s a good thing, frankly, sometimes,” she said, adding that business owners need to “encourage your people to come back to work.” Perhaps Daly and the San Francisco political leaders need to be serious about addressing the problems that continue to disfigure the city’s office market before anyone attempts to lure people to return to their offices?

Hit: Slowing Sketchy Flips. This week, a new law was enacted in Pennsylvania that requires anyone conducting residential wholesaling to obtain a real estate salesperson license under the state’s Real Estate Licensing and Registration Act. Residential wholesaling involves a wholesaler who secures a purchase contract from a seller and then flips the contract to a buyer without the seller’s knowledge or consent. Wholesalers typically seek distressed properties from an owner who wants to sell quickly and is unaware of the home’s market value – the wholesaler enjoys significant profits when flipping the property for a much higher price. Bill Lublin, incoming president of the Pennsylvania Association of Realtors, welcomed the new law by declaring it would “provide protection for consumers by requiring they receive proper disclosures, ensuring transparency throughout the transaction and giving them recourse if they encounter a problem.”

Hit: Fighting Back Against Rising Insurance Costs. Praise goes to a coalition of New York City-based affordable housing landlords who responded to spikes in property and liability insurance costs by creating their own insurance collective. According to a report from The Gothamist, the landlords, who are responsible for a combined 80,000 apartments, are dealing with a market where the average insurance cost for a single affordable unit soared from $869 in 2019 to $1,770 in 2023. The landlords’ new insurance venture is called Milford Street Association Captive Insurance Company, and members of the collective pool their money to cover claims. As collective member John Crotty observed, “If you don’t solve this insurance cost problem, you will not have affordable housing.”

Miss: Wait a Minute, Mr. Postman! On Sunday, the U.S. Postal Service (USPS) is raising the price of a first-class postage stamp from 68 cents to 73 cents – the second price increase since January. This marks a 5% hike from the previous price point and 10 cents higher than the price at the start of 2023. It is no surprise why this is happening – the USPS reported a $2.1 billion net loss during the first quarter of Fiscal Year 2024. For real estate professionals that rely on the USPS to transaction business, this is yet another unwelcome extra expense.

Phil Hall is editor of Weekly Real Estate News. He can be reached at [email protected].

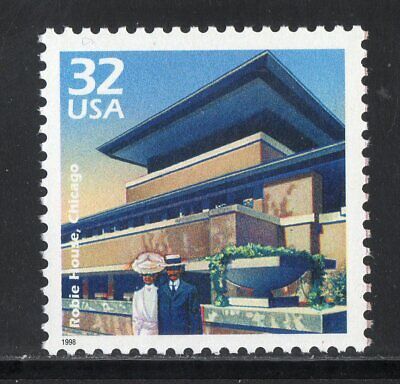

Photo courtesy USPS

Counterpoint…from the Texas Tribune:

With Gov. Greg Abbott out of the country on an economic development trip in Asia, Lt. Gov. Dan Patrick has served as acting governor amid the storm, making him responsible for putting in the state’s request for aid.

Neither Patrick nor Abbott claimed they had tried to contact Biden themselves, however. Federal law states that all requests for the president to issue a major disaster declaration “shall be made by the Governor of the affected State.”

Rafael Lemaitre, a former national director of public affairs for the Federal Emergency Management Agency, said Texas should have made its disaster appeal sooner, as widespread reports of power outages, deaths and property damage were “more than sufficient” to prompt the request. He noted that governors “can always amend their requests later as they get more information.”

Thank you Texas Tribune, really tired of everyone trying to blame Biden – especially since HE was the one to put the effort into getting aide started instead of the Governor/acting Governor doing their job