MOrtgage News & Insights

View top national motgage industry news articles, advice, insights, and more. Subscribe to UpdatesMost Recent Mortgage News

Get the top headlines in local and national mortgage industry news today in the articles below. Do you have news you would like to contribute? Submit a guest post here. To receive weekly updates on the top mortgage articles in your area, subscribe for free today!

loanDepot and Onx Homes Announce New Joint Venture

The companies did not announce the leadership for Onx X+ Mortgage. Continue Reading loanDepot and Onx Homes Announce New Joint Venture

Mortgage Application Activity Heats Up

The refinance share of mortgage activity increased to 39.0% of total applications from 37.1% the previous week. Continue Reading Mortgage Application Activity Heats Up

Mortgage Application Activity Slumps Again

The FHA share of total applications remained unchanged at 13.1%. Continue Reading Mortgage Application Activity Slumps Again

Mortgage Rates Moves Further from the 7% Mark

The 30-year fixed-rate mortgage averaged 6.86% as of June 27. Continue Reading Mortgage Rates Moves Further from the 7% Mark

Mortgage Application Activity Inches Up

The total number of home loans now in forbearance declined slightly to 0.21% as of May 31. Continue Reading Mortgage Application Activity Inches Up

Homeownership May Seem Out of Reach for Generation Z. How You Can Prepare Now

Source: Time --- Houses are expensive — and Generation Z will soon discover homebuying is not what it used to be. Those born between 1997 and 2012 are dubbed Generation Z or “Zoomers”– and 86% of them want to buy a home with 45% wanting to do it in the next five...

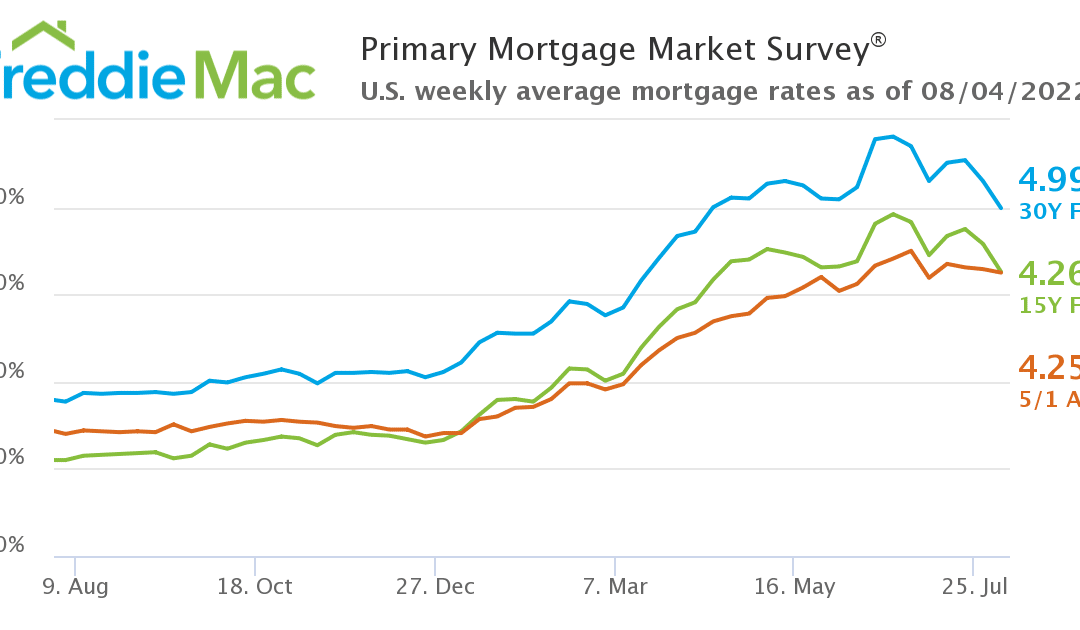

Current Mortgage Interest Rates: August 4, 2022—Mortgage Rates Trend Higher

Source: Forbes --- Today, the average rate on a 30-year fixed mortgage is 5.54%, according to Bankrate.com, while the average rate on a 15-year mortgage is 4.80%. On a 30-year jumbo mortgage, the average rate is 5.54%, and the average rate on a 5/1 ARM is 4.16%.

Seller beware: US homebuyers are backing out of deals at the highest rate since the start of the pandemic — here’s what that means for real estate

Source: Yahoo Finance --- As a well-known inflation-proof asset, real estate has been highly sought-after for most of the last two years. But things seem to be shifting. According to a new report from real estate brokerage Redfin, around 60,000 home-purchase...

Mortgage Rates Drop Below Five Percent

MCLEAN, Va., Aug. 04, 2022 (GLOBE NEWSWIRE) -- Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing that the 30-year fixed-rate mortgage (FRM) averaged 4.99 percent. “Mortgage rates remained volatile due to the...

Mortgage applications inch up for the first time in five weeks

Source: CNBC --- Mortgage applications inched up last week for the first time since June 24. Total mortgage demand increased 1.2% as the average 30-year fixed mortgage rate made the largest weekly drop since 2020. Applications to refinance a home rose 2%, according to...

Pablo Quintanilla: The Ghosts of Home Ownership

Source: KQED --- Hispanic homeownership in the U.S. climbed significantly in 2020 – there are now 8.8 million Hispanic homeowners in the country, according to a report released this week by the National Association of Hispanic Real Estate Professionals. That’s 725,000...

Retirement-Aged Homeowners Least Likely to Utilize Equity

Source: The M Report --- Hispanic homeownership in the U.S. climbed significantly in 2020 – there are now 8.8 million Hispanic homeowners in the country, according to a report released this week by the National Association of Hispanic Real Estate Professionals. That’s...

Total Household Debt Surpasses $16 trillion in Q2 2022; Mortgage, Auto Loan, and Credit Card Balances Increase

Source: New York Fed --- NEW YORK – The Federal Reserve Bank of New York's Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The Report shows an increase in total household debt in the second quarter of 2022, increasing by...

Poland’s mortgage holiday for households threatens bank profits

Source: FT.com --- As inflation soars and recession looms in Poland, a break from mortgage payments will be a much-needed reprieve for Jakub Rdzanek and his wife. The couple have seen their monthly home loan bills soar more than 70 per cent since the start of the...

Bank of England scraps mortgage affordability test

Source: The Guardian --- Thousands of potential homebuyers may find it easier to get on to the property ladder after a key mortgage affordability test was scrapped by the Bank of England. The central bank has said the change – taking effect from 1 August – should not...