MOrtgage News & Insights

View top national motgage industry news articles, advice, insights, and more. Subscribe to UpdatesMost Recent Mortgage News

Get the top headlines in local and national mortgage industry news today in the articles below. Do you have news you would like to contribute? Submit a guest post here. To receive weekly updates on the top mortgage articles in your area, subscribe for free today!

Mortgage Rates Tick Up Slightly

The 30-year fixed-rate mortgage averaged 6.22% as of Dec. 11, up from last week when it averaged 6.19% Continue Reading Mortgage Rates Tick Up Slightly

NYC Man Pleads Guilty to Using Mortgage Fraud for Buying Maine Marijuana Grow House

Ken Yiu faces up to 30 years in prison and a maximum fine of $1 million for the mortgage fraud count and 20 years in prison and a maximum fine of $500,000 for the drug count. Continue Reading NYC Man Pleads Guilty to Using Mortgage Fraud for Buying Maine Marijuana Grow House

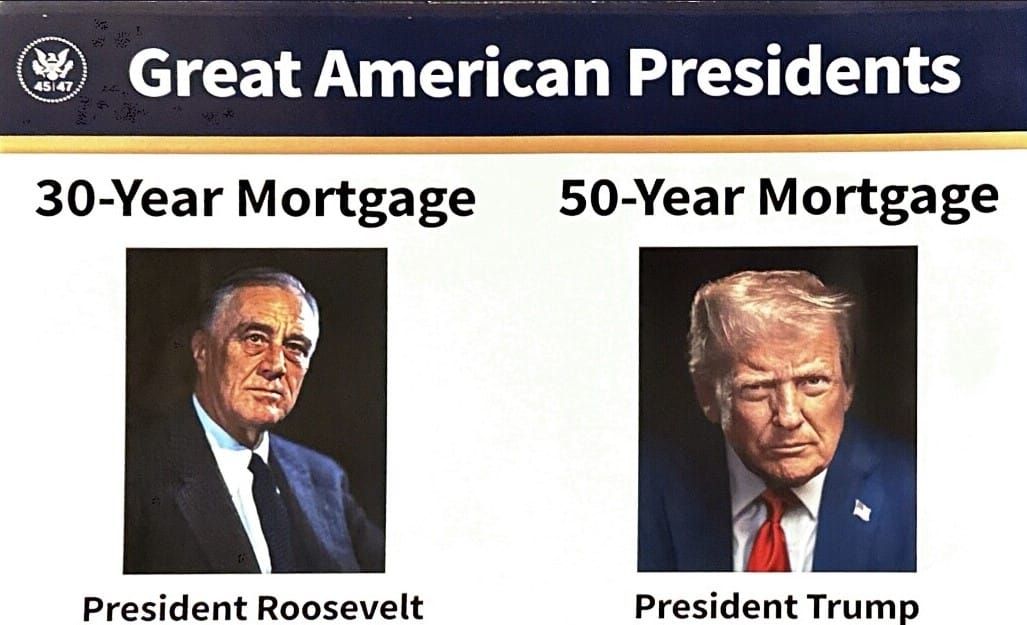

A Phil Hall Op-Ed: Trump’s Terrible 50-Year Mortgage Idea

Creating a 50-year mortgage with the goal of making housing more affordable is the equivalent of sending shipments of dinnerware into a famine-stricken region. Continue Reading A Phil Hall Op-Ed: Trump’s Terrible 50-Year Mortgage Idea

Trump Floats 50-Year Mortgage Proposal, But Many Conservatives Disapprove

FHFA Director Bill Pulte called the idea a “game changer.” Continue Reading Trump Floats 50-Year Mortgage Proposal, But Many Conservatives Disapprove

Mortgage Credit Availability at 3-Year High

“Credit availability in October rose to its highest level since 2022 as investors broadened their loan offerings over the month,” said MBA’s Joel Kan Continue Reading Mortgage Credit Availability at 3-Year High

loanDepot and Onx Homes Announce New Joint Venture

The companies did not announce the leadership for Onx X+ Mortgage. Continue Reading loanDepot and Onx Homes Announce New Joint Venture

Mortgage Application Activity Heats Up

The refinance share of mortgage activity increased to 39.0% of total applications from 37.1% the previous week. Continue Reading Mortgage Application Activity Heats Up

California Mortgage Firm President Arrested for DUI Collision That Killed 88-Year-Old Man

Melvin Joseph Weibel, the 88-year-old passenger in the Ford Transit van, was pronounced dead at the scene. Continue Reading California Mortgage Firm President Arrested for DUI Collision That Killed 88-Year-Old Man

Cornerstone Capital Bank Launches Community Lending Division

The bank stated it will seek “to close racial and economic gaps in homeownership and help families achieve their dream of owning a home.” Continue Reading Cornerstone Capital Bank Launches Community Lending Division

Bank of England Governor Warns Against Relaxing UK Mortgage Lending Guidelines

Andrew Bailey said the guidelines protected the nation against a wave of failed mortgages. Continue Reading Bank of England Governor Warns Against Relaxing UK Mortgage Lending Guidelines

Mortgage Rates Stay Just Under 7%

The 30-year fixed-rate mortgage averaged 6.95% as of Jan. 30. Continue Reading Mortgage Rates Stay Just Under 7%

Mortgage Application Activity Slows Down

The Refinance Index was down by 7% from the previous week and was 5% higher than the same week one year ago. Continue Reading Mortgage Application Activity Slows Down

Mortgage Rates Drop Below 7%

The 30-year fixed-rate mortgage averaged 6.96% as of Jan. 23. Continue Reading Mortgage Rates Drop Below 7%

Mortgage Application Activity is Dull, Forbearance Levels Drop

“Almost 43% of borrowers in forbearance were there due to a natural disaster,” said MBA’s Marina Walsh. Continue Reading Mortgage Application Activity is Dull, Forbearance Levels Drop

A&D Mortgage Acquires Wholesale Mortgage Origination Business from Mr. Cooper

The acquisition expands A&D’s broker network to more than 8,500 partners. Continue Reading A&D Mortgage Acquires Wholesale Mortgage Origination Business from Mr. Cooper