Source: U.S. News —

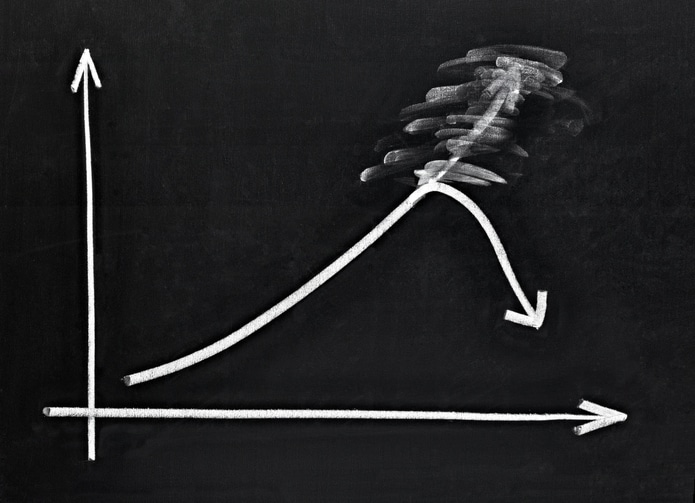

Mortgage rates have fallen every week for the past month, with the average rate on the 30-year fixed mortgage retreating further to 6.65%. Borrowing costs dipped across all fixed-rate mortgage products, including FHA loans, VA loans and 30-year jumbo loans. Meanwhile, adjustable mortgage rates stayed relatively stagnant.

Here are the current average mortgage rates, without discount points unless otherwise noted, as of Dec. 8:

- 30-year fixed: 6.65% (down from 6.84% a week ago).

- 20-year fixed: 6.53% (down from 6.7% a week ago).

- 15-year fixed: 5.98% (down from 6.13% a week ago).

- 10-year fixed: 6.03% (down from 6.18% a week ago).

- 5/1 ARM: 5.43% (down from 5.46% a week ago).

- 7/1 ARM: 5.57% (down from 5.61% a week ago).

- 10/1 ARM: 6.01% (up from 5.99% a week ago).

- 30-year jumbo loans: 6.66% (down from 6.85% a week ago).

- 30-year FHA loans: 5.96% with 0.07 point (down from 6.04% a week ago).

- VA purchase loans: 6.06% with 0.05 point (down from 6.11% a week ago).

“Mortgage rates decreased for the fourth consecutive week, due to increasing concerns over lackluster economic growth. Over the last four weeks, mortgage rates have declined three quarters of a point, the largest decline since 2008. While the decline in rates has been large, homebuyer sentiment remains low with no major positive reaction in purchase demand to these lower rates.”

– Sam Khater, Freddie Mac’s chief economist, in a Dec. 8 statement

Despite their lack of optimism, prospective buyers are in a window of opportunity to leverage stagnant homebuying activity for seller concessions, all while mortgage rates are steadily declining. Now could be the time to lock in a relatively good rate – especially when you consider that mortgage rates will likely stay elevated in the near future. Fannie Mae’s latest forecast suggests that the 30-year fixed mortgage rate will be around 7% throughout the first two quarters of 2023.