U.S. Housing Market Updates

View up-to-the-moment updates on the U.S. Housing Market. To receive weekly updates to your email inbox, click the "subscribe" button below. Subscribe to UpdatesCurrent U.S. Housing Market News

Get the top headlines in the current U.S. housing market in the articles below. Do you have news you would like to contribute? Submit a guest post here. To receive weekly updates with the top U.S. housing market updates and more sent to your mailbox, subscribe by clicking the button below.

FHLBank Topeka Awards $5 Million in Native American Housing Grants

This year’s grants are being presented to 16 tribes and tribally designated housing entities in Colorado, Kansas, Nebraska, and Oklahoma. Continue Reading FHLBank Topeka Awards $5 Million in Native American Housing Grants

Knock Rolls Out New Bridge Loan Plus

The product supports a variety of loan programs, including VA loans, and carries a one-time 2.25% fee Continue Reading Knock Rolls Out New Bridge Loan Plus

Mortgage Rates Inch Up Slightly

The 30-year fixed-rate mortgage averaged 6.30% as of Sept. 25, up from last week when it averaged 6.26%. Continue Reading Mortgage Rates Inch Up Slightly

Existing Home Sales Remain Flat

“Home sales have been sluggish over the past few years due to elevated mortgage rates and limited inventory,” said NAR Chief Economist Lawrence Yun. Continue Reading Existing Home Sales Remain Flat

Report: Housing in Q3 Grows Less Affordable Across Most of the Country

The nation hit a new record high median home price of $375,000 in the third quarter. Continue Reading Report: Housing in Q3 Grows Less Affordable Across Most of the Country

Redfin: Housing Affordability Improved Slightly in 2024

The median monthly housing payment for homebuyers hit a record of $2,920 in 2024, rising 4.3% from 2023 and 86% from 2019. Continue Reading Redfin: Housing Affordability Improved Slightly in 2024

A Phil Hall Op-Ed: Five Questions for the Trump Team

Editor Phil Hall asks the upcoming 47th president some questions regarding housing-related matters. Continue Reading A Phil Hall Op-Ed: Five Questions for the Trump Team

Texas Ranch Owned by Same Family for 145 Years Listed for $21 Million

The Padgitt Ranch in Coleman County was once the largest fenced ranch in Texas. Continue Reading Texas Ranch Owned by Same Family for 145 Years Listed for $21 Million

Albuquerque’s ‘Walter White House’ Listed for $4 Million

Since “Breaking Bad” aired, the home has attracted endless waves of fans taking photos of the 1,900-square-foot property. Continue Reading Albuquerque’s ‘Walter White House’ Listed for $4 Million

Hits and Misses for the Real Estate Week of Dec. 30-Jan. 3

An unlikely new site for affordable housing, a spike in CMBS delinquencies and a very long wait to sell a home. Continue Reading Hits and Misses for the Real Estate Week of Dec. 30-Jan. 3

California Estate Sells After 15 Years on the Market

The seller is real estate developer Khosro Khaloghli and the buyer was not identified. Continue Reading California Estate Sells After 15 Years on the Market

North Carolina Governor Expedites Purchase of Temporary Housing for Hurricane Victims

The governor’s office did not detail the eligibility process for residents in need of the new housing. Continue Reading North Carolina Governor Expedites Purchase of Temporary Housing for Hurricane Victims

Florida College to Offer Program on Building Tiny Houses

The program, which begins in August, will also help provide affordable housing solutions in Gadsden County. Continue Reading Florida College to Offer Program on Building Tiny Houses

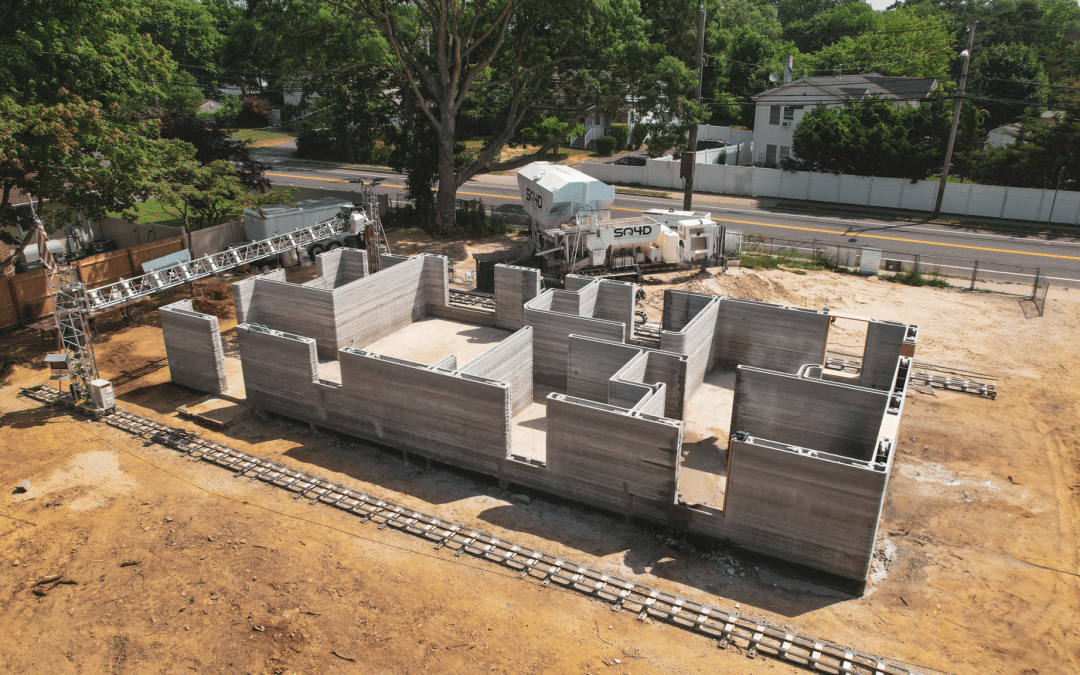

Tech Trends: Can We Print the Housing Inventory We Need Now?

Digital construction promises to build houses faster and more affordably than traditional construction methods. But can these technologies print something Americans would want to live in? One company says they will sell…and they are selling. Continue Reading Tech Trends: Can We Print the Housing Inventory We Need Now?

Mortgage Rates at Highest Level Since July

The 30-year fixed-rate mortgage averaged 6.91% as of Jan. 2. Continue Reading Mortgage Rates at Highest Level Since July