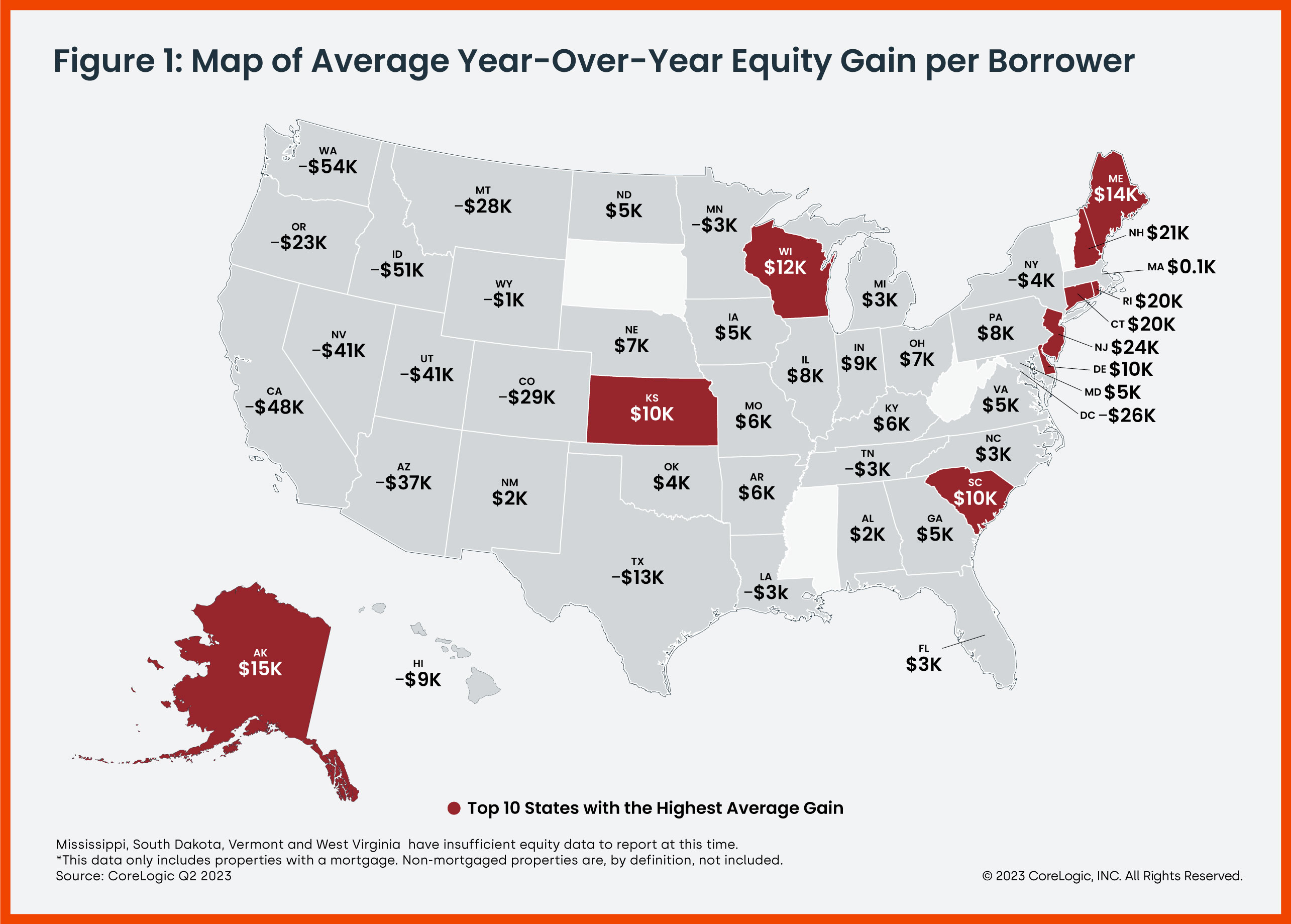

American homeowners with mortgages experienced a 1.7% year-over-year decline in home equity during the second quarter, according to new data from CoreLogic. This decrease represented a collective loss of $287.6 billion and an average loss of $8,300 per borrower.

On a quarter-over-quarter measurement, homeowners gained on average $13,900 in home equity, a collective increase of $806 billion or a 5.2% uptick.

The second quarter also recorded a 4% increase in the total number of homes in negative equity, totaling 1.06 million homes or 1.9% of all mortgaged properties. On a quarterly measurement, the total number of mortgaged homes in negative equity decreased from the first quarter by 6%.

“While U.S. home equity is now lower than its peak in the second quarter of 2022, owners are in a better position than they were six months ago, when prices bottomed out,” said Selma Hepp, chief economist for CoreLogic. “The 5% overall increase in home prices since February means that the average U.S. homeowner has gained almost $14,000 compared with the previous quarter, a significant improvement for borrowers who bought when prices peaked in the spring of 2022.”

“Also, while more borrowers are underwater compared with one year ago,” Hepp added, “they are not necessarily concentrated in markets that have seen the largest price declines, as negative equity also depends on the down payment. Natural disasters and related risks also play a substantial role in home equity changes.”