Source: Market Watch —

The U.S. stock market is experiencing a liquidation panic where everything is getting sold. The good news is such panics usually don’t last long.

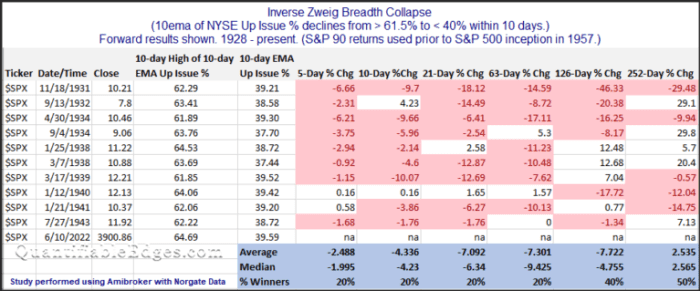

Analysis from Rob Hanna of Quantifiable Edges suggests a rare Inverse Zweig Breadth Thrust (ZBT). Although the sample size is small (n=10 since 1926), the bearish implications of the study are clear.

Take a deep breath. Notwithstanding the fact that negative ZBTs were not part of Marty Zweig’s work as detailed in his book, “Winning on Wall Street,” this study is nearing “torturing the data until it talks” territory. While positive ZBTs are rare buy signals, there have been six instances since the publication of Zweig’s book in 1986. Can you really trust the results of a study when the last instance of a negative ZBT was in 1943?