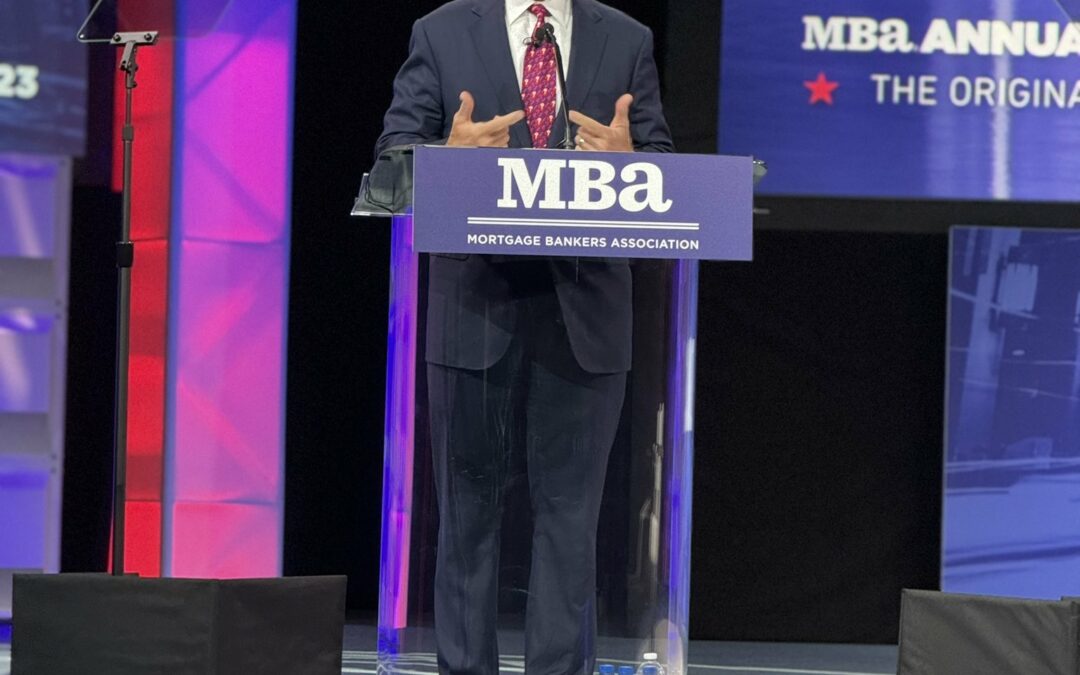

Philadelphia Federal Reserve President and CEO Daniel Harker addressed the Mortgage Bankers Association’s 2023 Annual Convention & Expo in Philadelphia this morning and admitted there was an absence of jubilation among the attendees regarding the central bank’s rate hike regimen.

“Let me put it plainly: I stand here this morning fully aware of the mood in this room,” said Harker. “And I am also fully aware of the way the actions we on the FOMC have taken over the past 18 months in our efforts to tame inflation and get it back down to our 2% annual target have, in their own way, contributed to the current mortgage climate. As you know, one of the pillars of the Federal Reserve’s dual mandate is price stability — getting inflation back to that 2% annual target. And while I am sensitive to the impacts higher policy rates have had, that goal remains job one.”

Nonetheless, Harker acknowledged the central bank’s role in shaping the housing market into its current lopsided state.

“Suffice it to say, the impact of rising mortgage rates was something that took front and center in nearly every conversation,” he continued, referring to his interactions with lenders and other stakeholders. “In fact, the climate could be crystalized in seven words, which one of those contacts said to me recently: ‘There are no first-time home buyers.’”

Harker also admitted that rising rates “not only raised borrowing costs on those looking to purchase a home, but it also contributed to the contraction of inventory. It is completely understandable that current homeowners won’t put their houses on the market and step away from their current low-rate mortgages. And it is just simple market dynamics that a lack of inventory would elevate prices overall, further lessening the depth of the pool of potential buyers.”

Harker then announced that he believed “we are at the point where we can hold rates where they are,” citing current economic data as the foundation for his claim. He commended the central bank for its policy, insisting “we are doing something – and I think we are doing quite a lot” to steer the economy away from high inflation while assisting the housing industry.

“I’m telling you something you already know: the rate of inflation in housing prices is similarly down from its peak levels,” he said. “I do see a steady disinflation under way, and I expect it to continue, with inflation dropping below 3% in 2024 and leveling out at our 2% target thereafter.”

As for cutting rates, Harker admitted that he had no immediate answer.

“As time goes by, as adjustments are completed, and as we have more data and insights on the underlying trends, I may need to adjust my forecasts, and with them my time frames,” he said. “But, as for future policy, I can tell you I do subscribe to the moniker, ‘higher for longer.’ I didn’t coin the phrase, but my expectation is that rates will need to stay high for a while.”

Photo courtesy Mortgage Bankers Association

As soon as buyers get used to 7.8% rates the housing inventory will dry up and allow sellers to raise their prices higher on homes that are worth half what they are selling for. They should continue a steady slow pace up unit builders stop overcharging. All those complaining of supply shortages will stop real quick once they get caught up from the COVID lock-down migration.

In our market the prices continue to rise. The shortage is continuing.

Builders materials and labor continue to rise so I don’t see your point about builders overcharging. Materials in demand will not decrease and no labor is asking for a reduction in pay. The value or worth of homes is what petard willing to pay. Check prices of 10 or more years ago. Always trending upward.

The feds say raising interest rates will control inflation. I wonder why they don’t focus on the SUPPLY CHAIN by encouraging new American owned and managed business to do the same.