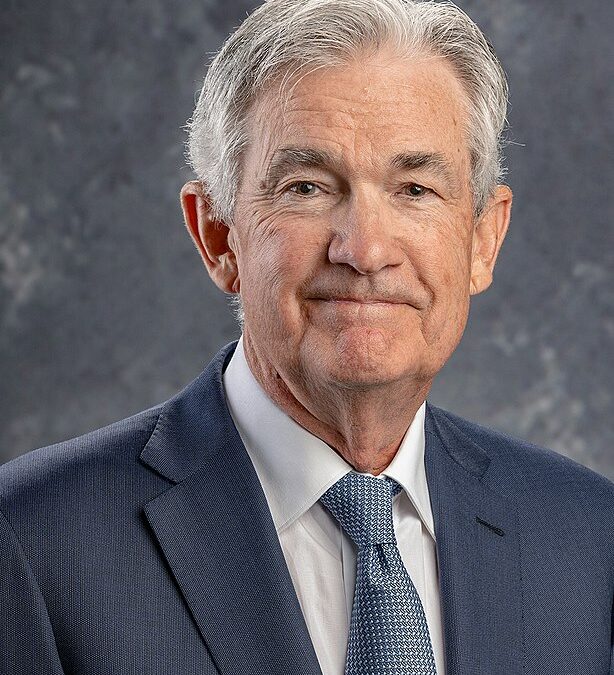

Federal Reserve Chairman Jerome Powell poured more cold water on the hope that the central bank will start cutting rates sooner than later.

According to combined media reports, Powell told a moderated discussion at the Foreign Bankers’ Association in Amsterdam that inflation was declining “on a monthly basis to levels that were more like the lower readings we were having last year.” However, the current pace of the downward motion did not warrant a rate cut, adding the Fed will “need to be patient and let restrictive policy do its work.”

“We’re just going to have to see where the inflation data fall out,” he said, noting that the central bank “did not expect this to be a smooth road, but these were higher than I think anybody expected.”

Since last July, the Fed has maintained the benchmark federal-funds rate in a range between 5.25% and 5.5%, the highest in two decades. Powell admitted that higher rates were not being planned.

“I have said that I don’t think it’s likely based on the data that we have that the next move that we make would be a rate hike,” Powell said.