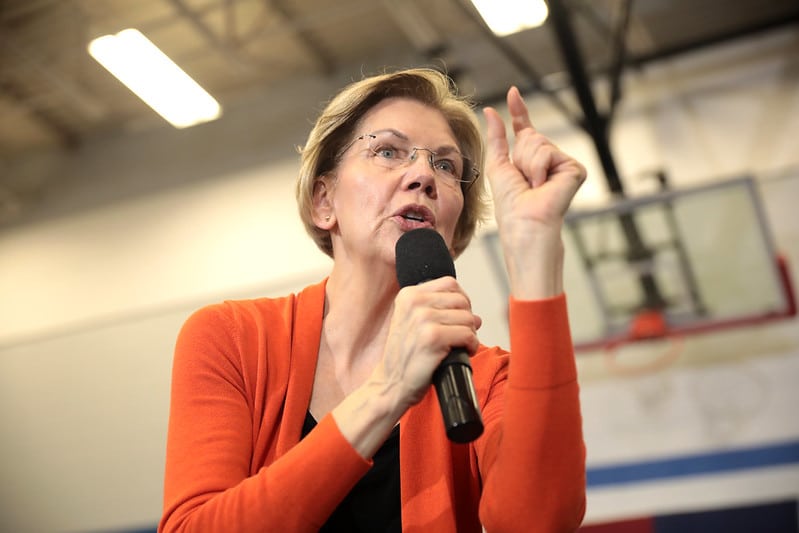

Sen. Elizabeth Warren (D-MA) is demanding the Federal Reserve cut the federal funds rate during its policy meeting this week.

Warren, joined by Sens. Jacky Rosen (D-NV) and John Hickenlooper (D-CO), wrote a letter to Federal Reserve Chairman Jerome Powell stating a rate cut will address inflation concerns while reversing further economic challenges.

“The Fed’s current interest rate policy is also having the opposite of its intended effect: it is driving up housing and auto insurance costs, which are currently the main drivers of the overall inflation rate,” the senators wrote, noting that “housing-related inflation is directly driven by high interest rates: reducing rates will reduce the costs of renting, buying, and building housing, lowering Americans’ single highest monthly expense. Lowering interest rates will likely also decrease the cost of auto insurance as well, which has risen due to factors completely unrelated to the cost of lending.”

Furthermore, the senators noted the impact of high interest rates on construction costs.

“The country is already facing a severe housing shortage, and the Fed’s refusal to bring down interest rates is exacerbating this shortage and driving higher inflation rates,” the senators added.

The senators noted last week’s rate cuts by the Bank of Canada and the European Central Bank, along with cuts by the central banks of several European countries. They also called attention to comments by Moody’s Analytics Chief Economist Mark Zandi, who decried high rates “are like a corrosive on the economy; you know, they wear the economy down, and at some point, something could break.”

The Fed will announce its decision of rate levels on June 12 at 2:00 p.m. EDT.

Photo: Gage Skidmore / Flickr Creative Commons

Jerome Powell has been doing this kind of of work all his life. He knows what he is doing. Elzabeth Warren is getting like Donald J. Trump, when he was president. Trying to force Powell to lower the interest rate.

Agreed. Politicians need to stay out of this before they f*ck it up even more. Leave the economy to the professionals.

If these politicians would not keep spending billions the interest rate could be reduced. I blame the current economy on our politicians period

If rates drop prices will rise as payment affordability determine price if rates were the issue prices would. Drop. Insurance is due to the rise in replacement costs. For auto the computers and other electronics drive up replacement. In housing construction costs drive up insurance. If they were interested in rates and costs they would credence the regulations that drive up costs, they would stop spending which would be huge. They are the problem not the Fed

Lloyd, I agree. This is a political grasp to save the WH and Congress democrats. Joe’s inflation, wild climate spending and associated over regulation is at fault here. follow the $.

Very straightforward and great information! People don’t get it and hear what’s really going on!

There is no real estate Supply that is why the prices are still going up. Why would anyone choose to move when they have a cheap 4-5% interest rate. Even if they buy down in price their payment will not go down . They will stay put and get a home equity. It is just making it harder for people to buy homes that need housing. Same thing happened in the early 90’s.

Higher Interest rates have not caused the home prices to rise, most homeowners have a rate between 1.9% and 4% and do not want to sell their homes with rates hovering around 7%.

Fed kept rates low for too long with quantitive easing to a tune of purchasing 4-5 billion dollars a day of US treasuries and mortgage backed Securities to keep rates artificially low

So now you have a squeeze on housing with less inventory than normal and demand to purchase still fairly strong in most parts of the US

Jerome Powell has been doing this kind of of work all his life. He knows what he is doing. Elzabeth Warren is getting like Donald J. Trump, when he was president. Trying to force Powell to lower the interest rate.

Things went south after the 2020 election. We just need to get back to what we had. Government is the problem. This woman is part of the problem.

You liked living in a disorganized pandemic that the last President continually lied about? Unemployment has gone down to lowest levels ever, GDP is highest in the world, stock market has been hitting continuous all time highs and we haven’t had a President destroying all of our foreign policies. There’s a reason nearly all of Trump’s cabinet that worked directly with him will not endorse him and say that he’s an existential threat and every presidential historian has declared that he is the worst president ever.

Senator Warren like former President Trump need to leave the Feds alone. Let them do their job. The economy has performed a miracle so far thanks to Powell’s leadership. Let him and his colleagues do their thing. People need to stop buying into this narrative that people are suffering when more people than ever are living their best life. More people than ever are shopping and traveling. This wouldn’t be the case if the masses are actually suffering financially. Let’s cut through the bullshit.

As a Realtor I would love to see rates drop. However it’s not the interest rates pushing home prices higher, it’s the lack of homes to sell to the number of existing buyers. The belief that lowering rates will give sellers a reason to move therfore resolve the inventory issue is nieve. Those sellers will still be buying.

Sen. Warren doesn’t seem to cite any facts, just a list of current complaints that will all be helped if The Fed will just bend a bit.

Hey Pocohontas,

Interest rates tripled as a result of the out of control trillion dollar bills you voted for and rammed thru! Bills like the “Inflation Reduction Act” which had NOTHING in it to reduce, only inflate, inflation. You voted for all the pork spending, money printing, debt increasing, interest increasing policies.

Now you want to politicize Mr. Powell’s (supposed) non-partisan position using a bully pulpit to harrass? Gaslight much?

Absolutely! We are watching CRE projects fail, the RE market is in a stall, first time home buyers can’t buy at all, and housing has become unaffordable overall. We need a drop of at least .50 to get it moving again

So far raising rates has not curbed inflation but has made houses and cars more expensive. I think it is time to try something new like lowering rates.

Yes it has. The inventory is skyrocketing because the rates are controlling demand. It takes time for the inventory to build up. That is how things work and it’s working well. The sellers and carmakers can start dropping their prices or face hardships with more competition. Being in the business I am surprised you have not experienced sellers that try and dictate what they want to sell their homes for. What they want for their homes does not reflect what it is truly worth.

If the economy is doing so great they should RAISE THE RATES. Governments shutting us down created the mess and then bailing the economy out caused over spending on limited supply. She should stay out of it.